Hurricane Bloomberg Hits Minnesota Pension Funds: TRA at 50% Funding or Worse

When I was in San Antonio, Texas last month at a conference, Hurricane Harvey was producing a mighty wind hundreds of miles from the eye of the storm. On Thursday of that week, Bloomberg Markets released a hurricane of its own with a story about Minnesota’s pension funds, “New Math Deals Minnesota’s Pensions the Biggest Hit in the U.S.”

According to a new Bloomberg report, under updated accounting standards (called GASB), Minnesota’s pension funds had plummeted from 31st to 7th in funding status among the states. Across all plans, the state admits to a 2016 deficit of $18 billion using its own wildly unrealistic assumptions; under more realistic assumptions, that number is more like $50 billion, though Bloomberg says it is over $108 billion. GASB is a long overdue transparency tool for those of us who are trying to get the public and elected officials to come to terms with pension math.

I bowed out of the conference to write an op ed for the Star Tribune (“State’s public pensions are in crisis”) which appeared on the front-page Sunday, September 10th. The pension plan directors were asked to respond to my commentary; their piece, which rolled out the same tired arguments, appeared on the jump page near mine. They accused me of “hyperbole” and said I was “ideologically opposed to defined-benefit pension programs. There’s something about the efficiency of pensions that irritates our detractors.”

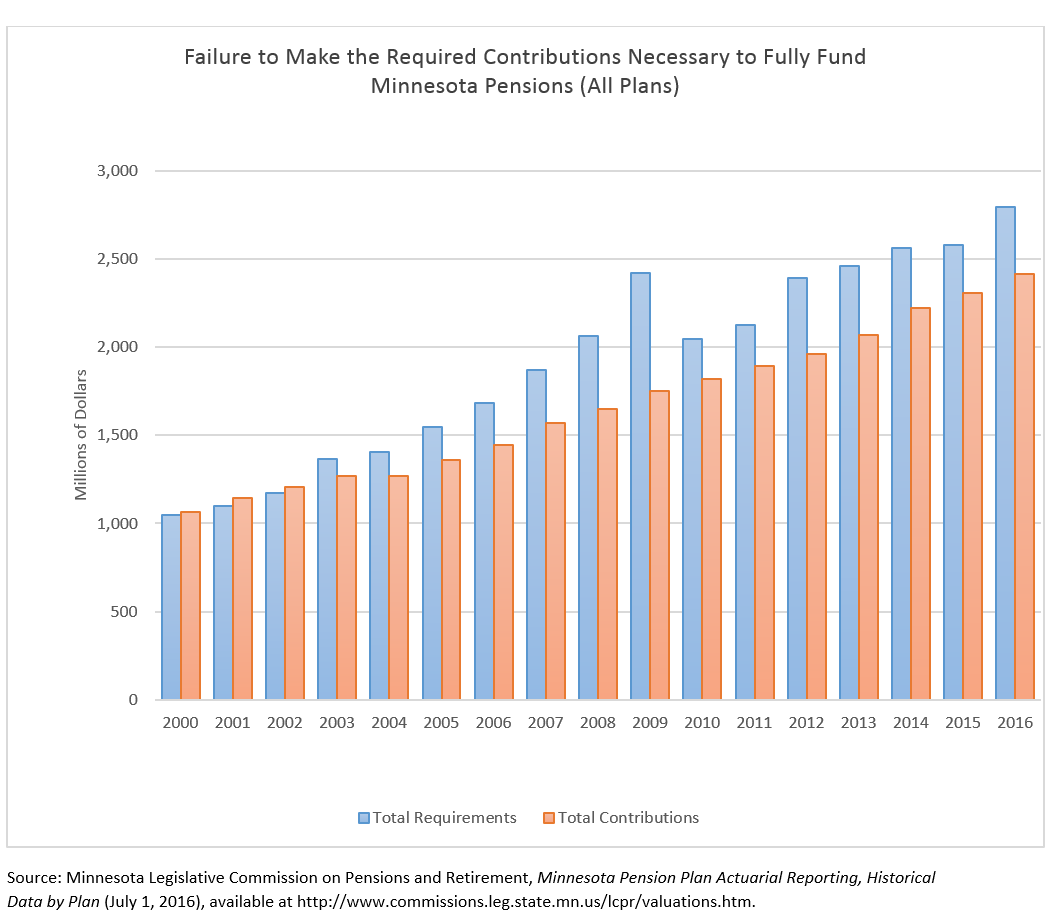

“Efficient” is not how I would describe Minnesota’s pension management. Efficiency is a traditional argument in favor of defined benefit plans—and in theory it should be true. But Minnesota has been violating the First Commandment of a defined pension benefit plan for years: fund the promises you make by putting side enough money each year to cover the benefit. And if you miss it one year, you had better make it up the next because once you get into a hole, it is hard to dig out even if your investments perform well.

Here is a graph that demonstrates how Minnesota dug such a deep hole:

The Bloomberg story continues to generate high winds here at home. I attended the pension commission meeting yesterday; we heard from the plan administrators, the state economist and the director of the State Board of Investment. In brief, it was a “CYA” fest of the first order—except the state economist. She has consistently pointed to more realistic assumptions about how to calculate both assets and liabilities, implying that the plans need to correct course ASAP.

The commission (made up of senators and state reps) has been working very hard to prop up the defined benefit system but they are constrained by so many political factors–not to mention that most legislators do not really understand pension math, try as they might. These busy folks get their briefings from the unions, the plans and other biased sources. Dayton, for a variety of reasons, vetoed their hard-won but ultimately inadequate attempts to right the ship (like lowering the assumed rate of return or ARR to 7.5%). Dayton takes his orders from government unions like Education Minnesota, AFSCME and SEIU—and the AFL-CIO representing cops.

The pension commission is a very tough committee assignment.

A fellow pension enthusiast, Mark Haveman from the Center for Fiscal Excellence, responded point by point to the plan administrator’s attempt to dismiss pension forecasters like me (and GASB) and thus shelter themselves from the Bloomberg storm (see link below). As for their claim to the “efficiency” of defined benefit plans, Haveman responded: “…these critics are not bothered by “efficiency,” but rather by the risk and exposure faulty accounting practices and other pension system policies create. “

Comments and letters poured into the Star Tribune, including one from Ross Bowen, an actuary married to a teacher in the Teachers Retirement Association (TRA) plan:

By the state’s assumptions, the TRA plan has $6.5 billion less than needed. By standardized national assumptions (GASB), the plan has $30.7 billion less than needed. [TRA director] Stoffel encourages us to rely on the state’s view, not the independent GASB’s. The GASB estimates are more reliable. They are set at arm’s length. The results are also very close to my estimates as an insurance company actuary. When states set their own assumptions, they may naturally pick ones that make things look better than they are. Minnesota’s assumptions are the most lax in the country.

Here is how that played out yesterday at the pension commission: TRA claimed that IF it had been in the pension bill last year, it would have been on course to reach 95% funding by 2046. Instead, assuming a still unrealistic 7.5% ARR, TRA says it will only be 50% funded in 2046, and would have been only 37% funded but for one good year in the stock market in 2017. But here is the hard fact: TRA has NOT been in the pension bill for the last two years.

Lee Schafer, the business columnist for the Star Tribune on Sunday, September 17, took TRA to task, “Pension plan cries foul over report using its data.” Schafer’s basic complaint was that TRA (and the other funds PERA and MSRS) was “saying its own accounting shouldn’t really be relied on.” Schafer (and Bloomberg) called out TRA because its funding status has gone from “a sizable financial hole” of $26.6 billion (actuarial) to a “crater” of more than $43 billion (GASB). TRA told Schafer that the GASB accounting report “was just a snapshot in time.” Schafer fairly responded, “Well, that’s true generally of financial reports.” He suggested that policy makers ask “plan administrators to please stop calling their own accounting incomplete and misleading.” Amen.

Schafer checked in with Mark Haveman, who has argued for years that the GASB standards, updated after the 2008 financial crisis, are not tough enough. That means that from an accounting standpoint, the pension math is even worse than GASB reports suggest. Not even I can grasp that if true.

Haveman wrote “An Annotated Rebuttal to State Pension Plan Directors’ Recent Star Tribune Commentary”. You should read it in its entirety if you are a the Governor, legislator or pension geek like me. If not, here is Mark’s sobering challenge, one that all elected officials and Minnesotans must face:

Should future generations of taxpayers be on the hook for both the employees of today and the employees that are providing service to them in the future? Because that is exactly what we are now doing, and based on our current path, we’ll being doing a lot more of in the future.

Bloomberg says we have a crisis—let’s not let it go to waste.