No, Xcel’s Pledge to be Carbon-Free by 2050 Does Not Make Good Business Sense

Lee Schafer of the Minneapolis Star Tribune wrote an article in the Sunday, December 9th edition of the newspaper stating that Xcel’s pledge to generate 100 percent of its electricity from “carbon free” sources by 2050 made good business sense.

Unfortunately, Xcel Energy’s plan will only make “business sense” for Xcel, companies like Mortenson Construction that are financially invested in the renewable energy industry, Xcel’s shareholders, and non-government organizations like Fresh Energy that promote renewable energy sources like wind and solar despite their high cost and low reliability.

These stakeholders will profit at the expense of Minnesota families and businesses who will be forced to pay higher costs to keep the lights on. It would have been nice if Mr. Schafer had sought the opinion of an organization that didn’t stand to benefit from Xcel’s announcement in his article.

First off, let’s clarify that Xcel Energy is not really a private business. It is a government-sanctioned monopoly utility company that has exclusive charter to sell electricity within a given service territory, which simply means that Xcel’s customers have no choice but to purchase their electricity from Xcel, even if they think the costs are too high.

Furthermore, the government guarantees Xcel Energy a guaranteed 10 percent profit on every dollar they spend on infrastructure. This means every wind turbine, solar panel, and transmission line built bolsters Xcel’s profits, regardless of whether these power plants are needed to meet electricity demand, or whether it will be good for their consumers.

Either way, the house, or Xcel, always wins.

Unfortunately, the Strib article completely whiffed on this fundamental concept, and the author appears to have taken the cheese regarding arguments that claim the transition to a “carbon dioxide free” energy system will be easy, and affordable. It will not.

According to the article:

“We’re buying wind at less than $20 a megawatt hour today,” [Xcel Energy CEO Ben] Fowke said. “That compares to $65 where it was 10 years ago. That is a better deal than I can do on the fossil side, and that’s even with low natural gas prices.”

This price for wind generation includes the effect of a federal production tax credit subsidy, which is scheduled to roll off. Fowke said the expiring subsidy will lead to only a “temporary uptick” in cost, and added that he was once skeptical that there would be any more significant efficiencies to be gained from wind generation.”

Fowke is correct when he says heavily-subsidized wind power is cheap (the subsidy for a megawatt of wind is $24 per megawatt hour), but this is a very incomplete look at the total cost of electricity that is paid for by ratepayers. Sometimes the wind produces a lot of electricity, but sometimes it produces zero electricity.

Despite zero wind on the system, the lights stay on because coal, natural gas, and nuclear plants churn out steady, reliable electrons. Ratepayers do not get a deal because we must pay for both the wind turbines, and the reliable generators that provide power when the wind is not blowing.

Essentially, ratepayers pay twice (or thrice) for electricity they use once.

The article seems to try and assuage these incongruent arguments by framing “carbon free” energy as a value added product that is somehow both lower cost, but worth the extra cost. The author writes:

“As Fowke described it, a low enough price for power is obviously part of giving customers what they want. They want carbon-free energy but don’t want to pay any more for it, and they sure don’t want to see the electric utility take a technology risk that means the lights might not come on when it’s time to open for business on Monday.”

Notice how “a low enough price for power” is not a statement saying power prices will be lower in the future thanks to wind. It is not a guarantee that the company will provide electricity for the lowest-possible costs. It is a value judgement made by the CEO of Xcel stating that power prices will be “low enough,” whatever that means, as the company increases costs to reduce carbon dioxide emissions.

As Fowke acknowledged, ratepayers want carbon free power, but they don’t want to pay more for it. Ratepayers would be unlikely to support these actions if groups like Fresh Energy were not misleading them into thinking wind and solar are cheap because they have no fuel costs.

Quoting Mike Noble of Fresh Energy, Schafer wrote:

“The customer’s case for clean energy is actually an easy one to make, said Michael Noble of the clean energy research and advocacy group Fresh Energy. Solar and wind generation do not need any purchased fuel. That means that unlike fossil fuel generation, renewable generation isn’t vulnerable to spikes in prices for gas or coal, so customers can plan on stable costs for electricity.”

This is a bait and switch.

Wind and solar have no fuel costs when they are generating electricity, but according to data from the Energy Information Administration, wind and solar in Minnesota produce electricity only 35.5 and 15.7 percent of the time, respectively. This means coal or natural gas must produce electricity 64.5 percent, or 84.3 percent of the time to make sure the lights stay on.

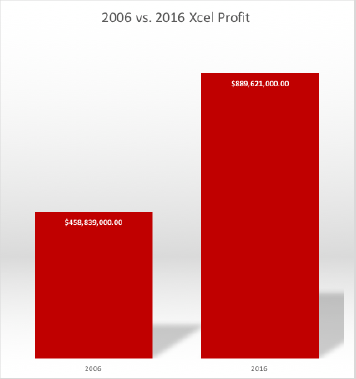

The intermittent and unpredictable nature of wind and solar means customers are still exposed to fluctuations in fuel prices, plus, these customers must simply pay additional costs to keep the wind turbines, solar panels, and coal and gas plants running. This is bad for ratepayers, who see their electricity prices skyrocket, but it is a windfall for Xcel shareholders who see plans to decarbonize the grid as a chance to build more power plants, and thus increase their returns.

The graph below shows the increase in Xcel Energy’s stock prices from 2006 to 2016.

No wonder shareholders were giddy about the announcement. According to Schafer:

“Fowke said Xcel’s chief financial officer has been taking telephone calls from shareholders, and Fowke understood them to be more curious about Xcel’s carbon-free pledge than skeptical.

“It’s important that they see it as something positive,” Fowke said, “because if they do, it almost assures that other utilities across the nation will adopt this model.”

At last check, at the end of a very rough week for U.S. stocks, Xcel Energy shares traded at just a touch under their 52-week high price, at more than $53 per share.”

Ultimately, this plan is great for parties with financial ties to the renewable energy industry, and bad for everyone else.

In fairness, Xcel deserves some credit. The carbon free pledge makes much more sense than 100 percent renewable energy pledge because it leaves open the possibility the utility will utilize nuclear, hydroelectric, and carbon capture and storage to meet its goal, rather than rely on unreliable, intermittent, and expensive resources like wind and solar power.

However, the move is also incredibly self-serving and enriches Xcel’s shareholders at the expense of families, miners, manufacturers and other business owners in Minnesota.

Schafer either does not understand how the electricity system works or is unwilling to expose it. The readers of the Star Tribune deserve to hear a perspective on energy policy that stand to benefit from Xcel’s announcement.