It’s All About the Subsidies, Baby! Minnesota’s Wind Farms Are Being Rebuilt to Capture More Subsidies

The Lake Benton Wind (LBW) Farm in southern Minnesota is being retooled to improve turbine performance and reliability, but most importantly, it is being rebuilt to generate federal production tax credits.

According to North American Wind Power, in 2017, ALLETE Clean Energy announced an $80 million project that includes replacing select blades, gearboxes and generators on turbines at the Lake Benton wind farm in Minnesota’s Lincoln County and the Storm Lake I and II wind farms in Iowa’s Buena Vista and Cherokee counties.

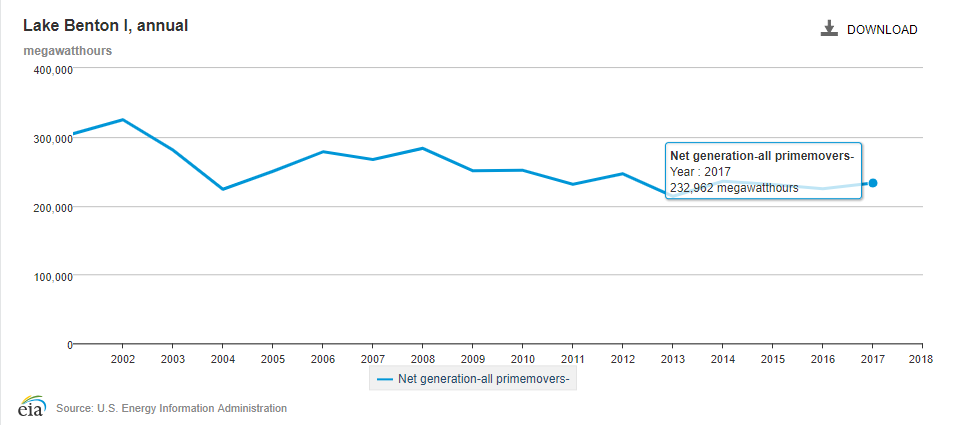

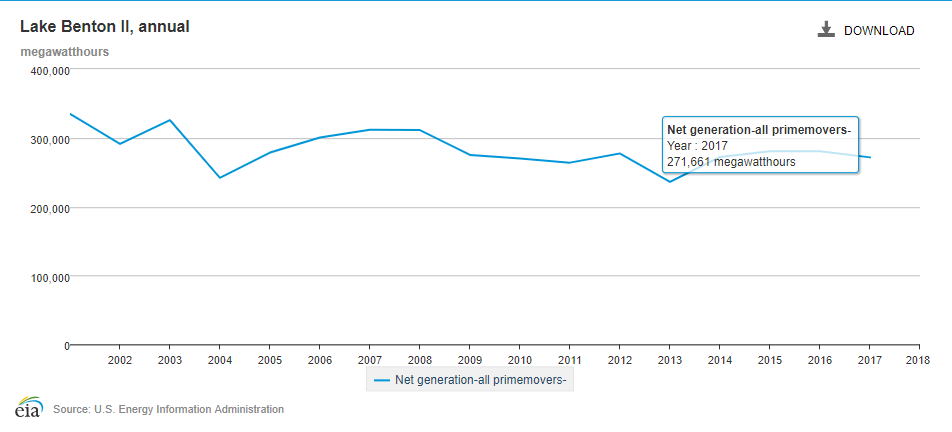

The Lake Benton 1 facility was placed into service in 1998, and Lake Benton 2 was placed into service in 1999. Output from these facilities has been steadily declining since the early 2000’s, the earliest years statistics are available from the Energy Information Administration.

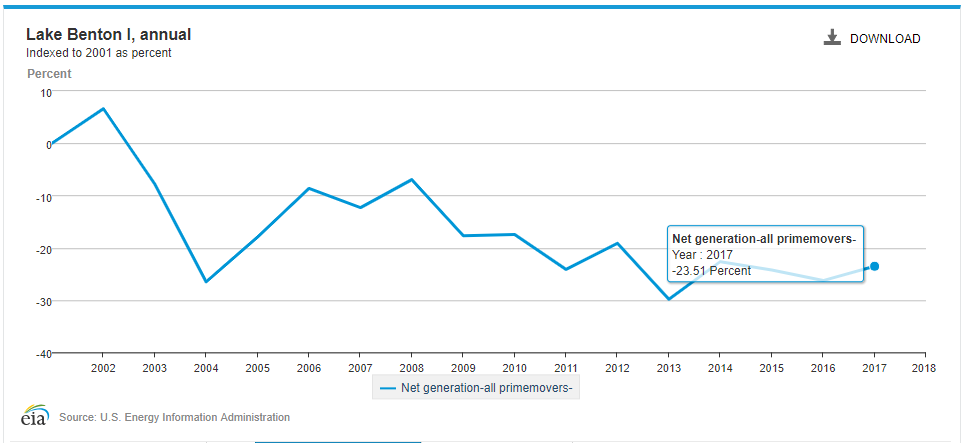

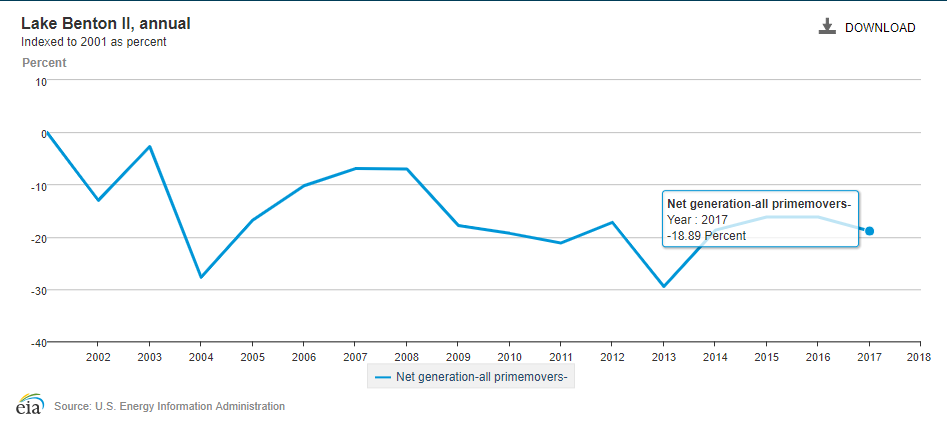

By 2017, the Lake Benton 1 facility was operating at a 25 percent capacity factor, and Lake Benton 2 was operating at approximately 30 percent of its rated capacity. In terms of percentages, this means the Lake Benton 1 and Lake Benton 2 facilities were generating 23.5 percent less electricity, and 19 percent less electricity, respectively, in 2017 than they were in 2001.

Not only will repowering these wind turbines increase their electricity production, but it will enable the project to qualify for federal subsidies all over again.

Subsidies for wind power occur in the form of the the wind production tax credit (PTC). The PTC generates a $24 federal tax credit for each megawatt hour of electricity produced, and the credit is paid for ten years after a wind facility is placed into existence. This means the LBW facilities have been operating subsidy free since 2008 and 2009, but it appears their owners are looking for one last dip into the federal coffers before the tax credits expire.

These tax credits are supposed to expire at the end of 2019, but they won’t really. This is because the IRS has generous rules that push the effective ending date out until 2022. Instead of expiring immediately, wind projects can qualify for the federal subsidy if the developers have spent 5 percent of the total cost of the wind project before the tax credit expires, and as long as the project comes online within four years of this expenditure, they qualify for the subsidies. As a result, a project started in 2017 will have four years to come to fruition while scooping up the full $24 per megawatt hour in federal subsidies.

This is the exact timeline for the LBW facilities.

This timeline is perfectly rational. As Warren Buffett has said, it doesn’t make sense to build wind turbines without the tax credit.

Although some organizations use conservative-sounding language and claim that wind and solar are cost competitive with traditional sources of electricity, they never advocate for repealing the 25 percent mandate for renewable energy in Minnesota, which is the single-largest distortion in Minnesota’s energy markets, and they never advocate for repealing federal subsidies for wind and solar, either. This is probably because they know it doesn’t make sense to build wind without the tax credit.

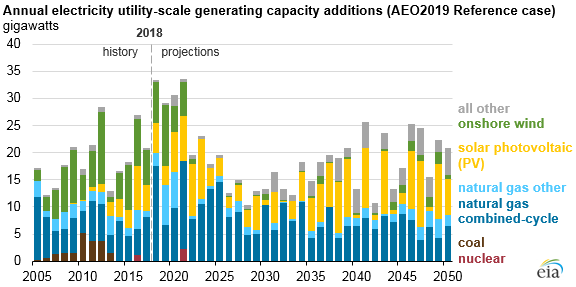

Recent projections from the Energy Information Administration show that investments in wind facilities, indicated in green, will essentially disappear once the subsidies are gone. So much for there being a market for wind sans subsidies.

In the end, the timeline for repowering these wind facilities strongly suggests it’s all about the subsidies, baby.