Your Taxes, My Friend, Are Blowing in the Wind

You’re probably all in chipper spirits after having filed your taxes, so I thought that you might like to know that Warren Buffett is grateful that a chunk of your tax payment will go into his pocket as part of the wind Production Tax Credit (PTC). Here’s how it works:

Wind turbines receive a $24 tax credit for every megawatt hour of electricity they generate for 10 years after the windmills come into production. This tax credit allows wealthy investors, like Warren Buffett, to reduce the tax liabilities of their companies while also allowing them to sell this electricity to the grid. Otherwise, there would not be an incentive to build wind turbines.

Buffett admitted as much to an audience in Omaha, Nebraska:

“I will do anything that is basically covered by the law to reduce Berkshire’s tax rate. For example, on wind energy, we get a tax credit if we build a lot of wind farms. That’s the only reason to build them. They don’t make sense without the tax credit.”

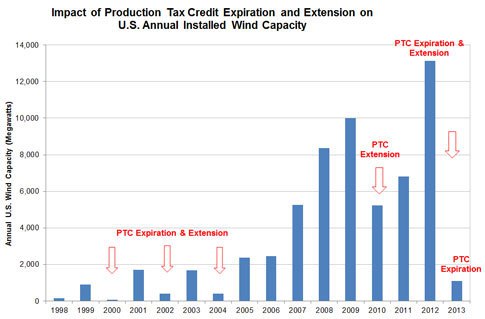

Historical data support this statement, as investment in the wind industry has plummeted when the tax credits have expired, as shown below.

The tax credits, not the inherent economic competitiveness of wind energy, are the primary reason why wind turbines are constructed.

This is why PacifiCorp, a Warren Buffett-owned utility with customers from California to Wyoming, recently said it would spend $3.5 billion bringing hundreds of new wind turbines online over the next three years, before the production tax credit expires in 2020.

There are plenty of people who believe that wind turbines are cost competitive with other sources of energy, but these analyses do not include the cost of the transmission lines needed to transport wind energy (which regularly cost $2 million per mile) or the cost of running conventional power plants as backup sources of electricity in case the sun isn’t shining or the wind isn’t blowing.

This is why Minnesota has seen skyrocketing electricity prices over the last several years, as shown in the video below.

https://www.youtube.com/watch?v=D8Vz_eJw4k8&feature=youtu.be

In the end, wind turbines are constructed because federal subsidies allow wealthy folks to build wind turbines and offset their tax liabilities, thereby shifting the costs onto taxpayers and consumers.