The state government itself says that Gov. Walz’ corporate tax hike will be paid by ordinary Minnesotans

Yesterday, Gov. Walz unveiled his budget for the 2022-2023 biennium. In it, he proposed a hike in the corporate income tax rate to 11.25%. Gov. Walz is pushing hard on the argument that this is a ‘progressive’ tax measures which will only hit ‘the rich’. However, his own Department of Revenue disagrees.

As I’ve written before, one of the great myths of public policy is that politicians decide who pays a tax. They might call it something like the ‘corporate income tax’ in the expectation that corporations will pay it, but whether or not they actually do or, instead, pass it on to consumers in the shape of higher prices and/or workers in the shape of lower wages is completely beyond the politician’s control. Just because it is called the ‘corporate income tax’ does not mean that corporations actually pay it.

While a tax might be levied on a corporation, the incidence of the tax tells you who actually bears the burden. There is a decent sized body of empirical literature attempting to quantify exactly who bears the burden of corporate taxes. These studies suggest that labor bears between 50% and 100% of the burden of the corporate income tax, with 70% or higher the most likely outcome. Hiking corporate tax rates, then, is simply a hike in taxes on worker’s incomes.

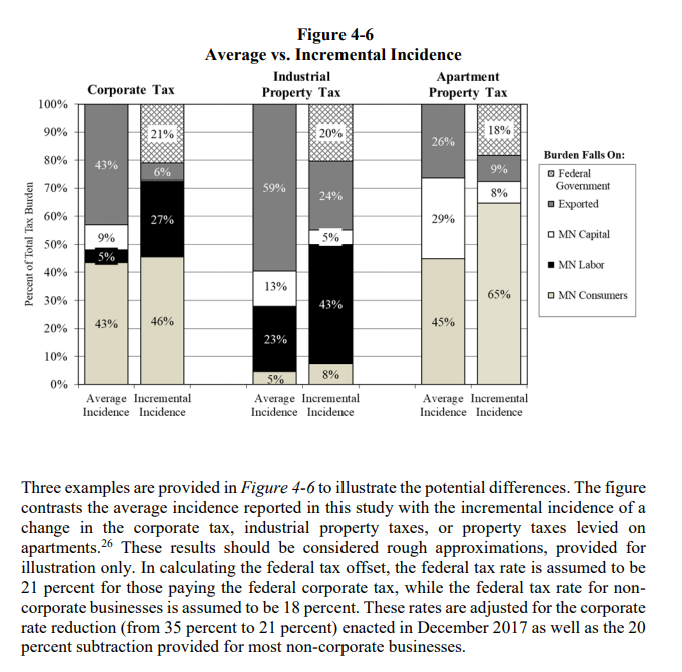

The Minnesota Department of Revenue estimates tax incidence for our state. In its 2019 Minnesota Tax Incidence Study, they calculate the “incremental incidence of a change in the corporate tax”. They find that 46% of the burden of this increase falls on Minnesota’s consumers in the form of higher prices and 27% falls on our state’s workers in the form of lower wages and employment opportunities. None of the burden falls on capital in the form of lower dividends. Simply put, Gov. Walz’ proposed corporate income tax hike – which would push us up to the second highest rate in the United States – is a regressive tax change.

If Gov. Walz is going to try selling this measure over the coming weeks as a progressive tax change to hit ‘the rich’, don’t believe him: it isn’t true.

John Phelan is an economist at the Center of the American Experiment.