It isn’t Minnesota’s high taxes that make it a great place to live or get educated

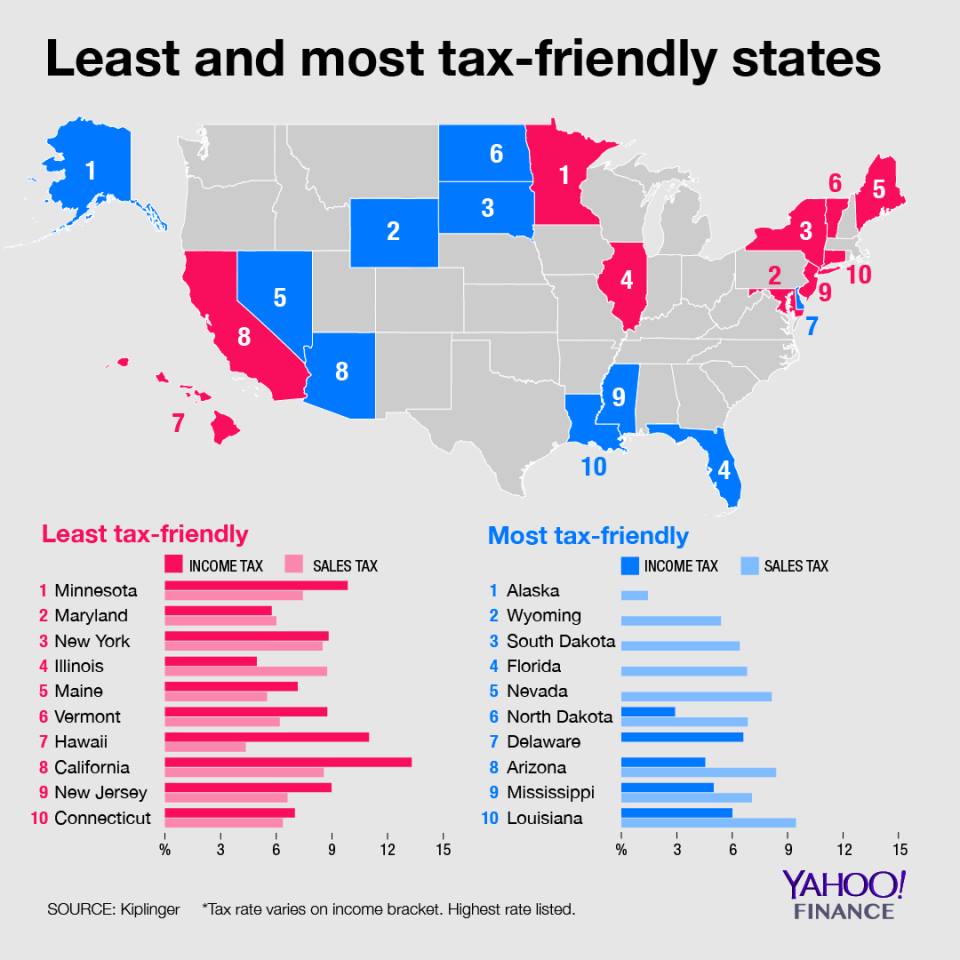

State rankings are an evergreen topic. Recently, the map below popped up on social media prompting much discussion, much of it all too familiar.

High taxes don’t make a place nice to live in

One comment read

Notice that then most tax friendly also have highest rates of illiteracy, poorer schools, health care quality, and overall just terrible places to live

This is a common argument, that high taxes are the price we pay for a nice place to live. But it isn’t true, as I’ve written before.

Figure 1, below, compares the state rankings according to U.S. News and World Report [Best States Rankings] and their rankings for overall tax burden from the Tax Foundation.

Figure 1: Best states and high tax states

Source: U.S. News and World Report and the Tax Foundation

We see no strong relationship between a state’s tax burden, as measured by the Tax Foundation, and whether it is a better or worse state, according to U.S. News & World Report. Simply put, the causal relationship of ‘High taxes > Better state’ which these people posit, just does not exist. Washington and New Hampshire, the two states which rank above Minnesota, rank an average 20th and a low 6th for tax burden compared to Minnesota’s 43rd. The two states which U.S. News & World Report rank below us, Utah and Vermont, have relatively low (8th) and relatively high (41st) tax burdens respectively.

High taxes do not mean great education

Another comment read

Now compare those to education rankings

Well, I already did.

I put together a scatterplot of all fifty state’s rankings for their Individual Income Taxes taken from the Tax Foundation and their rankings on scores from the National Assessment of Education Progress (NAEP). There is no correlation between how high a state’s tax burden is and how well its education system performs, as Figure 1 shows.

Figure 1 – State rankings for Individual Income Taxes and their scores on the National Assessment of Education Progress

Source: National Assessment of Education Progress and the Tax Foundation

Incidentally, when you look at the state’s entire tax burden, taking in corporate taxes, individual income taxes, sales taxes, property taxes, and unemployment insurance taxes (again from the Tax Foundation), you see much the same story, as Figure 2 shows.

Figure 2 – State rankings for overall tax burden and their scores on the National Assessment of Education Progress

Source: National Assessment of Education Progress and the Tax Foundation

So…

The argument that high taxes such as Minnesota’s are necessary to support a great living environment or strong education system just isn’t supported by the data. It is based on the notion of a trade off which doesn’t exist. It is why people say, as someone did, “You go have fun in Mississippi or Louisiana, then, OK?” and not “You go have fun in New Hampshire, then, OK?“. Because New Hampshire is, by some rankings, a very nice place to live and is so with a much lower tax burden than Minnesotans face. We should be asking ourselves why we have to pay so much more than residents of the Granite State for pretty similar outcomes. We are not getting the value we should from our high taxes.

John Phelan is an economist at the Center of the American Experiment.