The high cost of failure

Minnesota has made meager progress in reducing greenhouse gas emissions since 2005. And it has cost a fortune.

Minnesota’s primary energy policy goal is to reduce greenhouse gas emissions (GHG) 15 percent below 2005 levels by 2015, 30 percent by 2025, and 80 percent by 2050. To date, Minnesota has not come close to meeting these goals.

Minnesota’s Energy Policy Fails by its Own Measure

In the latest biennial report to the legislature on GHG emissions, state agencies found that GHG emissions “decreased slightly, about 4 percent, from 2005 to 2014.” That is far short of the 15 percent by 2015 goal.1 To reach GHG emission reduction goals, Minnesota might pay lip service to a broad-based strategy, but, in reality, the strategy focuses almost entirely on reducing emissions from electricity generation. This strategy is failing and will continue to fail.

Wind and Solar Power are Not Driving Down GHG Emissions

The most glaring failure of Minnesota’s energy policy is this: Increases in renewable energy such as wind and solar power are not driving down carbon dioxide emissions.

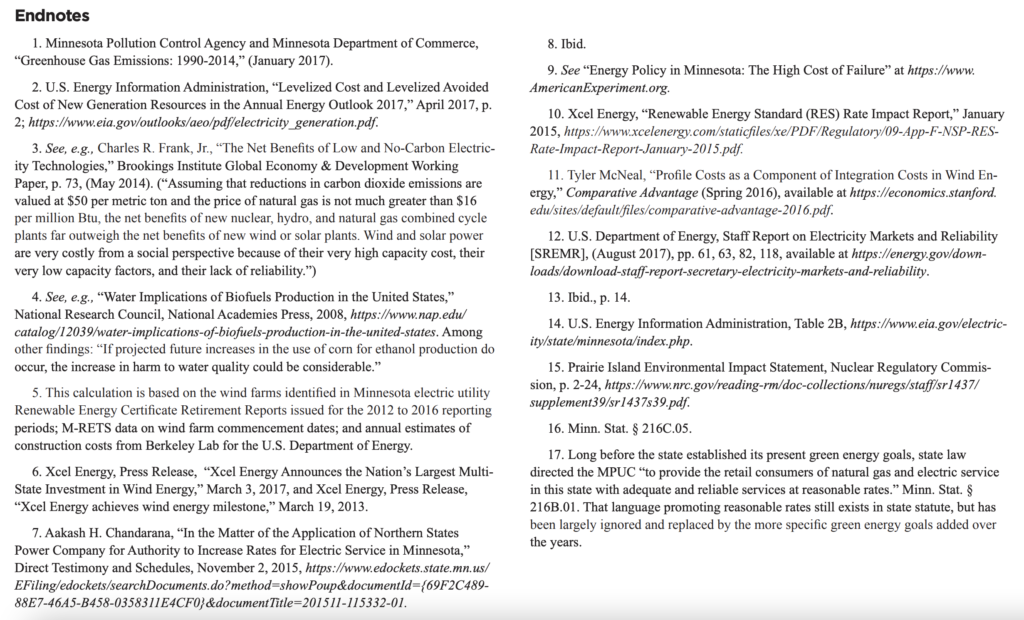

Minnesota’s carbon dioxide emissions have fallen only slightly during the same time period it has vastly expanded its renewable energy, and progress in decarbonizing its electricity supply has actually reversed course in the last three years. Figure 1 shows CO2 emissions trends dating back to 1990. After falling 15 percent from the peak in 2005, total CO2 emissions rose 10.4 percent between 2012 and 2014. Overall, CO2 emissions dropped 6.6 percent from 2005 levels. By this measure, there is no way Minnesota will come close to meeting its 15 percent by 2015 GHG emissions reduction goal. State agencies, accounting for all GHG emissions, report even less progress—only a 4 percent reduction in 2014 compared to 2005.

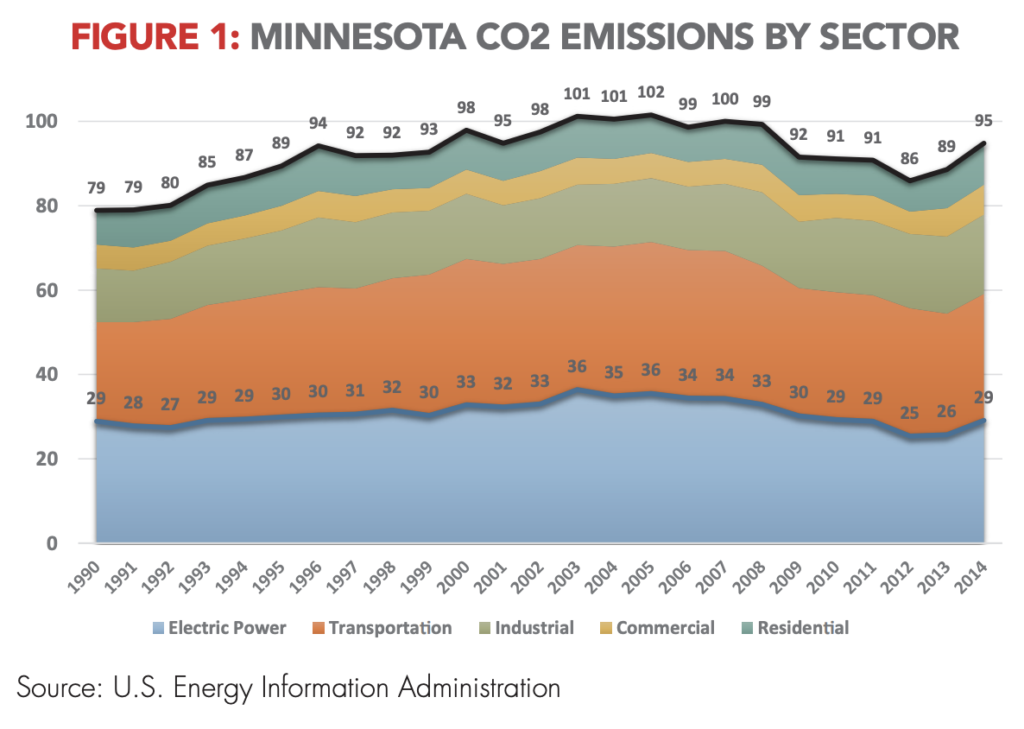

The failure of wind power to reduce CO2 emissions is made especially evident in Figure 2 below, which shows that carbon dioxide emissions from the electricity sector in 2014 were the same as they were in 1990 when there was no wind power in the state. While electric power carbon emissions are lower today than in 2005, the state has made little to no progress since 2009, even as electricity generated by wind increased by 92 percent. Note that the dip in emissions in 2012 and 2013 is directly related to a catastrophic failure that took down Minnesota’s largest coal-fired power plant for 22 months, beginning in November 2011.

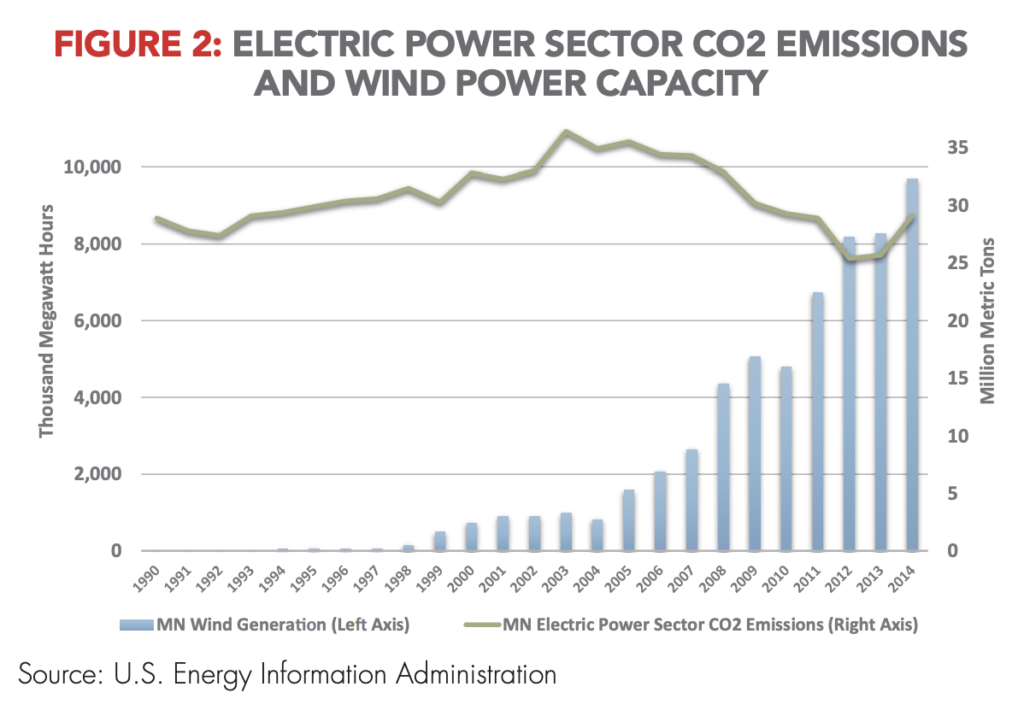

Wind power’s failure to meaningfully reduce CO2 emissions in Minnesota is also revealed by comparing Minnesota wind generation and emissions trends to the U.S. as a whole. If wind works well to reduce carbon emissions, then Minnesota’s electric power sector should be experiencing far greater emissions reductions than the U.S. However, Figure 3 reveals that CO2 emissions in Minnesota’s electric power sector dropped by about the same level as the U.S between the 2005 baseline and 2014. Despite wind generating 17 percent of Minnesota’s electricity—substantially higher than the 4.4 percent wind generation across the U.S.—electric power sector emissions dropped by 18 percent in Minnesota and 15 percent in the U.S. Again, the apparent drop in 2012 and 2013 in Minnesota is entirely due to the catastrophic failure of Minnesota’s largest coal-fired power plant.

The U.S. does better than Minnesota when comparing total greenhouse gas emissions. Between 2005 and 2014, GHG emissions dropped by 9.3 percent across the U.S. compared to a 6.6 percent drop in Minnesota.

Why Renewables Fail and Will Continue to Fail

Intermittency

Understanding why renewables fail begins with the inherent intermittency of wind and solar power, which requires backup generation from conventional sources of electricity to assure grid stability during periods of peak demand. The U.S. Department of Energy classifies wind and solar power as non-dispatchable technology—that is, wind and solar are not “on demand” sources of electricity because they depend on optimal wind conditions and sunshine. Solar power obviously produces no power at night (or in the winter when panels may be covered with snow or ice), and wind power falls if the wind stops blowing or blows too hard.

Dispatchable electricity sources include coal, natural gas, and nuclear. The Department of Energy estimates what it calls the capacity factor of different sources of electricity—that is, how much of the time the source can be relied upon to produce power. Coal, natural gas and nuclear power can all produce power 85 to 90 percent of the time, any time of day or night, under any weather conditions. Importantly, down time for these power sources is generally predictable and easily planned around. By contrast, despite improvements in wind and solar technology, the Department of Energy estimates that onshore wind power has a capacity factor of only 41 percent (up from 35 percent in 2014), while solar power has a capacity factor of just 25 percent. Southwestern Minnesota has a higher capacity factor than the national average (approximately 50 percent) because of more favorable prevailing wind conditions, but the bulk of Minnesota’s electricity usage is in the eastern half of the state, requiring extra expense for transmission lines from most wind power facilities. Conventional electricity generation facilities can be sited close to existing grid resources and end-users.

The most important factor in thinking about the resource mix of electricity generation is that electricity has to be available at constant and predictable amounts 24/7. Here is how the Department of Energy describes it: “Since load must be balanced on a continuous basis, units whose output can be varied to follow demand (dispatchable technologies) generally have more value to a system than less flexible units (non-dispatchable technologies), or those whose operation is tied to the availability of an intermittent resource.”2

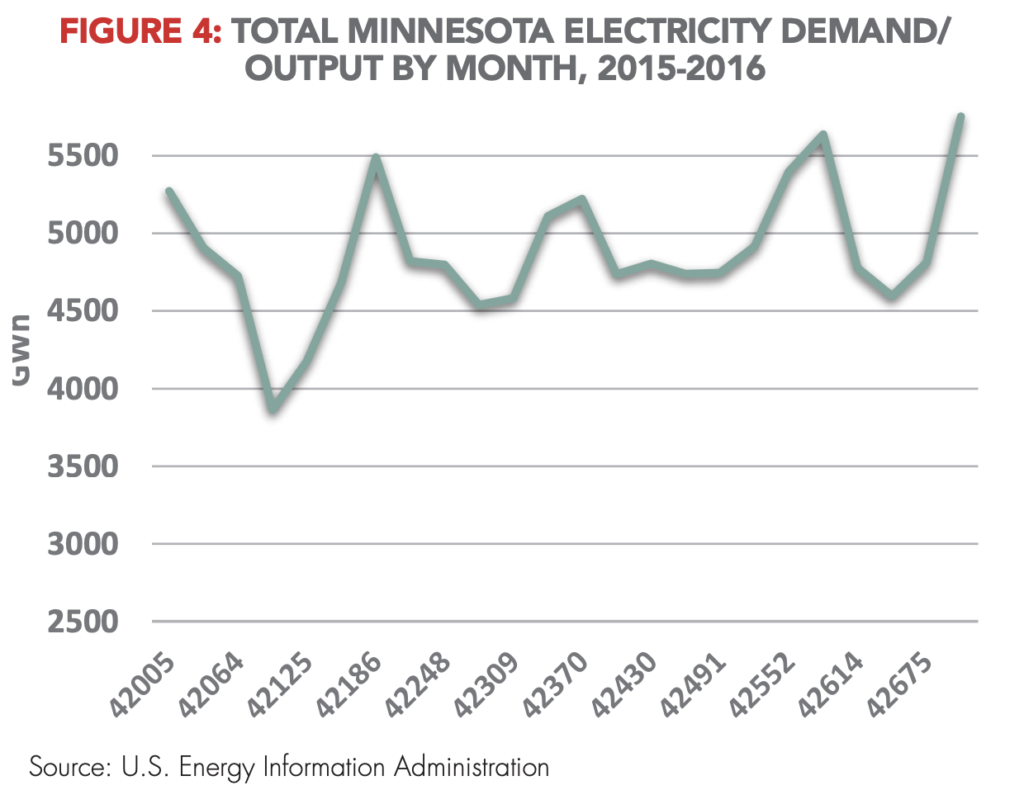

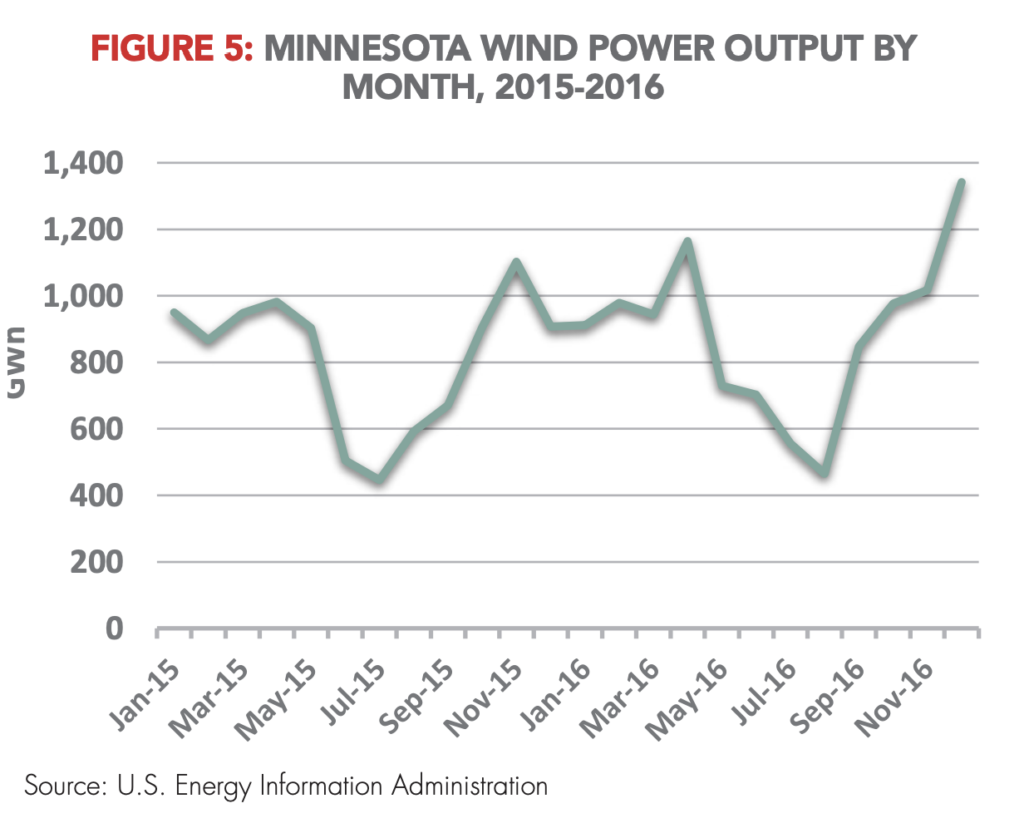

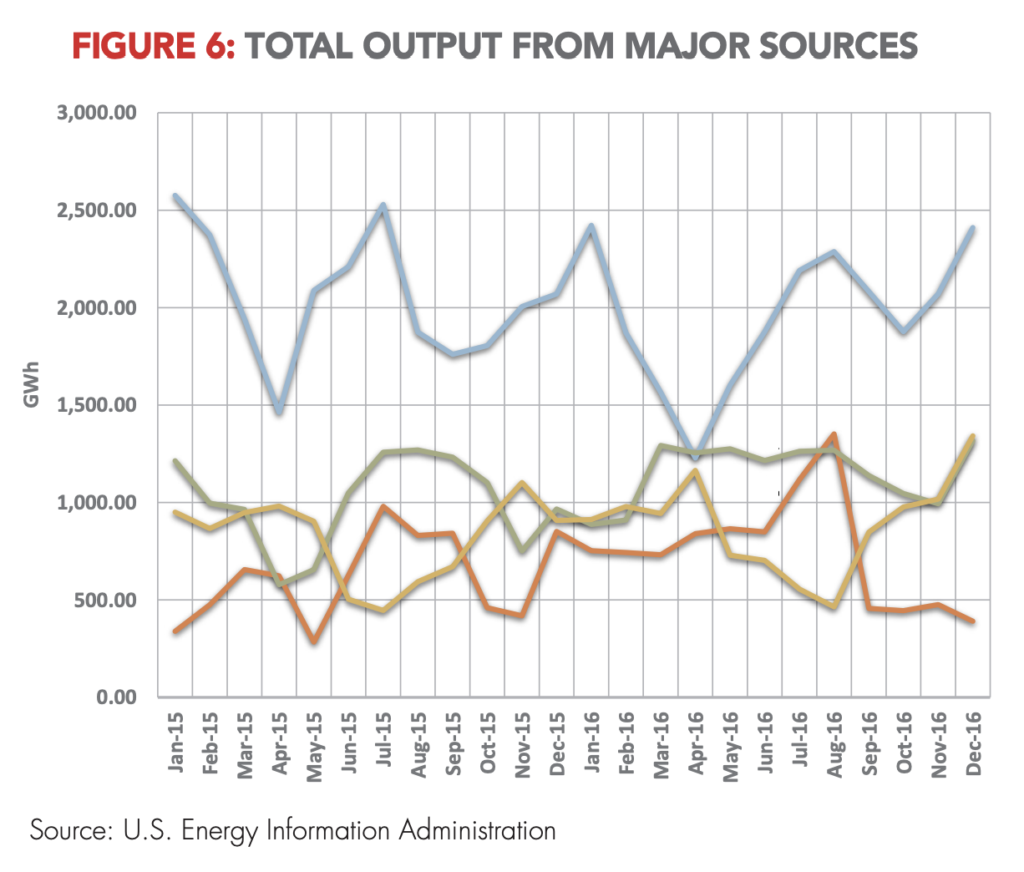

Electricity demand in Minnesota varies by time of day and by as much as 40 percent by season, from its lowest points in the spring and fall (when the weather is mildest) to its highest points in the middle of the summer and around the holidays. The data show that wind power produces the least amount of power in the hot summer months when annual power demand peaks. Wind power performs okay in the winter months, but falls precipitously—as much as 50 percent—in the summer months when demand is highest. (See Figures 4 through 7.) When wind power in 2016 slumped by 60 percent in August, the gap was mostly filled by coal-fired and gas-fired power. Coal power increased output 82 percent between April and August in 2016. (See Figure 6.)

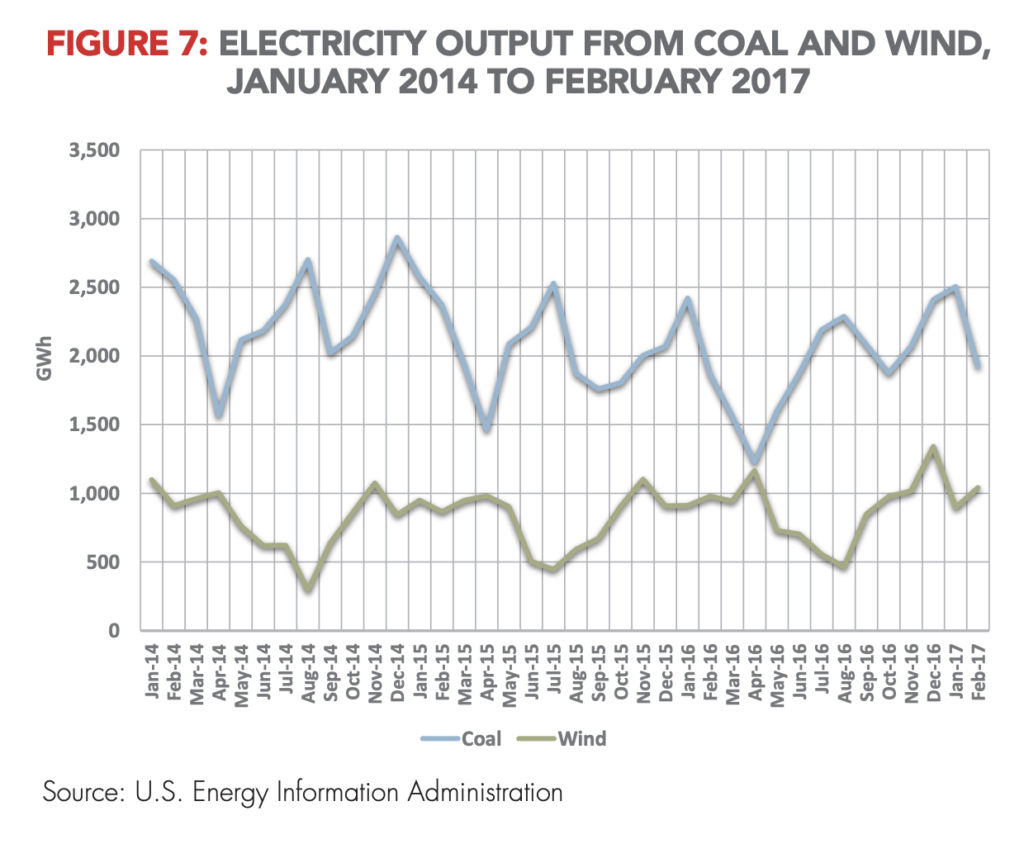

This point bears restating in stronger terms. A closer look at the actual power output data reveals facts contrary to the narrative of the claimed benefits of greater renewable capacity. Coal accounts for more than 90 percent of total CO2 emissions from the electric power sector, and the fact that total coal-fired electricity production has fallen by much less than the amount of new wind capacity accounts for the lack of progress in reducing CO2 emissions. This is because coal—much more than natural gas—is the swing producer, i.e., coal is the primary backstop when wind production falls.

The inverse relationship between coal and wind output can be seen vividly in Figure 7 below, which displays the relationship between coal and wind output from 2014 through February of 2017. Notice especially that coal power increases sharply in the summer months when wind power declines because of slack prevailing winds. Wind power performs best in the winter months, when power demand experiences its second peak period of the year, but here again Figure 7 shows that coal-fired power is the swing producer in meeting the higher demand.

Natural gas

If the primary object of Minnesota’s energy policy is decarbonization, it should allow undistorted market forces to determine the mix of sources to displace coal. This may mean wind in some cases, but will probably mean more natural gas. Numerous studies show the most effective emission reduction strategies rely primarily on natural gas, not wind.3 Natural gas emits far lower emissions than coal without any of the severe intermittency problems posed by renewables.

Minnesota’s experience compared to the U.S. strongly suggests the state is making a serious mistake by focusing too much on wind and solar. While Minnesota has been ramping up wind, most of the rest of the country has been shifting to natural gas. Minnesota is also relying more on natural gas, but not nearly as much as other states. Between 2005 and 2015, natural gas generation grew from a 5.1 percent share to a 13.0 percent share of Minnesota’s electricity generation. By contrast, natural gas grew from an 18.8 percent share to a 32.7 percent share across the U.S. These data suggest the rest of the country, by relying on natural gas, achieved the same, but still limited level of emissions reduction as Minnesota, but at a lower price. Recall that it was during this same time-period that Minnesota lost its historic electricity pricing advantage.

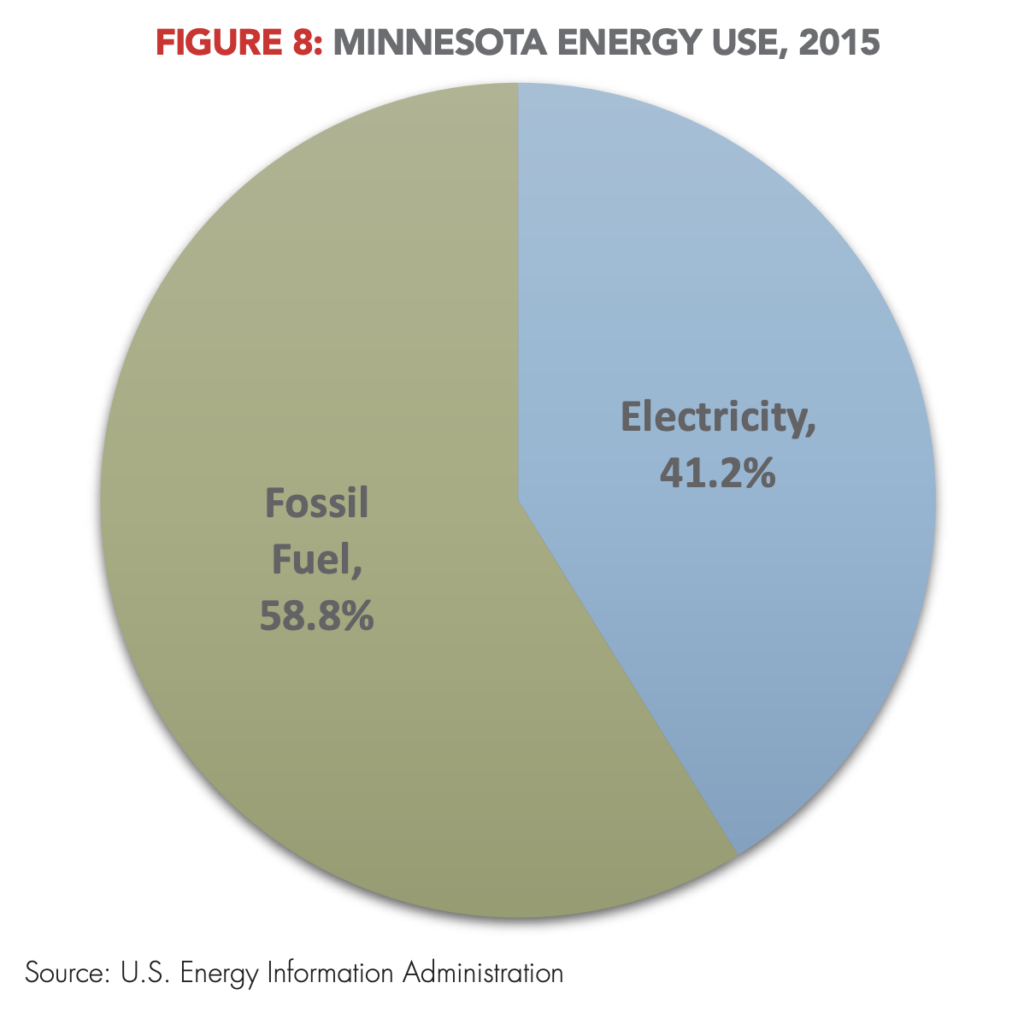

Emphasis on electricity generation addresses only a fraction of energy use

Even if Minnesota were to devise a better strategy to reduce emissions from the electric power sector, the impact on total GHG emissions would still be very limited. Electricity, as shown in Figure 8, only accounts for about 40 percent of final energy use in the state. More important, 70 percent of fossil fuel consumption in Minnesota is used for purposes other than generating electricity, such as transportation and home heating, which is predominantly supplied by natural gas. This means that the principal emphasis of Minnesota’s energy policy is aimed at a fraction of overall energy use. Generating 25 percent of Minnesota’s electricity from renewable sources would mean that it would only be generating about 15 to 20 percent of total energy from renewable sources at best.

Biofuels Production may be Reaching its Limit

Efforts to address emissions in the largest fraction of energy use—liquid fuels—emphasize biofuels, especially ethanol blended with gasoline. This is another policy that piggybacks on national mandates and subsidies, though it is far from clear that ethanol is environmentally preferable to conventional gasoline.4 In any case, the U.S. Environmental Protection Agency has recently reduced the mandated level of ethanol blending in the nation’s gasoline supply, and hints at further reductions in the years ahead, far short of the original ambitious target contemplated by the Bush Administration in 2005. In other words, the U.S. appears to be close to the limit for the production and use of corn-based ethanol.

Minnesota also appears to be reaching its biofuel production limits. As the “Minnesota’s 2025 Energy Action Plan” notes, Minnesota is far off track from reaching its biodiesel content mandate of 20 percent biodiesel by 2018. Presently, Minnesota can only deliver 55 percent of the biodiesel capacity to meet this mandate.

The historic reliability and robustness of American energy systems has led Americans to take energy for granted. With a few extraordinary exceptions, transportation fuel is always in abundance, and the lights come on whenever we flip the switch. In fact, our energy systems are highly complex. Simplistic mandates will stress complex energy systems—especially the electricity grid—as they scale up.

The Cost and Collateral Damage of Minnesota’s Energy Policy

The little progress Minnesota has made in reducing emissions since 2005 has come at a great cost. There is of course the cost of building out wind and solar generation capacity. On top of this financial cost, the build-out of renewables also puts the stability of the electric grid at risk and removes substantial acreage of land from productive use.

The Difficulty of Estimating the Cost of Minnesota Renewable Energy Mandate

It is difficult to estimate with any precision the cost of Minnesota’s rapid expansion into renewable electricity generation.

However, make no mistake, government mandates come at a cost. There are a number of costs involved with mandating renewable energy.

• Stranded costs: Adding new renewable generation when new generation is not needed results in stranded costs related to the loss of value in retiring the existing generation before it has reached the end of its useful life.

• Transmission costs: The geographic dispersion of renewables requires substantially higher investments in transmission to connect to the people who will use it.

• Backup costs: Renewables’ intermittency—the fact that they produce zero electricity when the wind does not blow or the sun does not shine—requires extra generation to always be online as a backup.

• Baseload cycling costs: Ramping this extra backup baseload generation up and down to accommodate intermittency also comes at a cost to both efficiency and wear and tear.

• Curtailment costs: When the renewables produce too much electricity at low demand times, power producers must, at times, shut them down. Under certain contracts, a utility must still pay for the power not produced.

• Profile costs: Maybe the largest cost—the profile cost—results from the fact that wind provides electricity at low demand times (the spring, the fall, and the middle of the night) when prices are very low.

Accounting for all of these factors is incredibly challenging. Adding to the challenge, Minnesota’s major investor-owned utility (IOU), Xcel Energy, has little to no incentive to accurately account for the cost. As an IOU, Xcel receives a guaranteed rate of return on all approved capital expenditures. Thus, so long as spending on renewables is approved, it is guaranteed a higher return. The only thing moderating Xcel’s move to renewables is the possibility of losing price sensitive industrial customers. However, many of these customers, especially in the mining industry, are outside of their service territory.

Building Wind Farms to Meet Minnesota’s Mandate Has Cost an Estimated $10.6 Billion to Date

While it may be difficult to precisely estimate the full cost of Minnesota’s renewable energy mandate, the cost to build out the wind farms currently serving the state’s mandate amounts to around $10.6 billion. Every year utilities report on the renewable energy credits (RECs) they use to satisfy the state’s renewable energy standard (RES). These RECs are linked to the specific renewable electricity generating facilities responsible for the credit, including both utility-owned and independently-owned facilities. Based on these reports, Minnesota utilities depend on wind farms with about 5,000 MW of nameplate capacity to meet the state mandate. The cost of building out these windfarms can be estimated by matching the year a windfarm is built with the capacity-weighted average cost of installing wind for that year, as reported by Berkeley Lab. Add it all up and the wind mills currently meeting Minnesota’s RES cost around $10.6 billion to build.5

These investments are largely in addition to the regular capital investments necessary to maintain the existing system. Though Xcel Energy might issue press releases claiming renewables are “cost-effective” and at times even claim they are the lowest-cost choice, even Xcel must be forthright in legal filings before the Minnesota Public Utilities Commission (MPUC).6 In Xcel’s latest request for a rate increase they were asked to explain recent capital investments. Here is their response:

For at least the last five-years, we have focused on investing in carbon free generation—specifically our nuclear generating units and new wind generation resources—and the transmission system needed to deliver this generation to load. These investments were in addition to the capital investments we always need to make in our distribution, transmission, and generation assets to help ensure we can safely and reliably serve our customers.7 [Emphasis added]

Why did they make these additional investments in carbon-free generation? As they explain, state and federal policies required them.

The State of Minnesota and the federal government have set forth environmental and policy goals that we are obligated to meet. We are also obligated to meet North American Electricity Reliability Corporation (NERC) system reliability standards, and we take seriously our obligations to provide quality customer service and a safe working and operating environment. These needs exist at all times.8

Looking through other filings for rate increases reveals that most utilities at least in part blame Minnesota’s RES for the need for higher rates.9

Transmission Costs

As Xcel acknowledges in its rate increase request, a portion of its capital investment in recent years went to fund transmission upgrades needed to deliver the new load from new wind facilities. This represents a substantial and often overlooked component of the cost of mandating renewable energy. According to Xcel’s most recent Renewable Energy Rate Impact Report, transmission project costs attributable to Minnesota’s RES equal $1.8 billion.10 This is no doubt a conservative estimate. Assuming a similar cost to the rest of Minnesota’s utilities, installing new transmission to meet the RES costs roughly $4 billion statewide.

Profile Costs

Wind is a very low “value” energy source. That’s because the wind blows the strongest and, therefore, produces the most electricity when demand for electricity is the lowest. This is true on both a seasonal and a daily basis. Wind blows strongest in the spring and the fall and at night when electricity usage is the lowest. As a result, wind on average sells at a lower price than other sources of electricity. The lower sale price imposes a cost, which is referred to as a “profile cost.” At many times during the year, the demand for power when the wind is blowing is so low that the price of wind goes negative, meaning utilities must literally pay someone to take their wind power.

This profile cost is hard to quantify because wind production data is usually considered proprietary and nonpublic. However, one wind farm in Minnesota—the Wapsipinicon wind farm—has published this data. A review of this data confirms that the contract for this wind farm has cost the Southern Minnesota Municipal Power Agency (SMMPA) millions of dollars.11 SMMPA contracted to buy wind at 6.2 cents per kWh in 2012 and 6.3 cents per kWh in 2013. Yet the wind on average only sold for 1.8 cents per kWh in 2012 and 2.4 cents per kWh in 2013. That resulted in a loss of $14.6 million in 2012 and $12.7 million in 2013, compared to what SMMPA could have paid buying electricity on the wholesale market.

Less Grid Stability

On top of these quantifiable costs, a basic threshold question about wind is rarely asked or answered: Can wind power guarantee reliable, on-demand electricity? Until there is a substantial breakthrough in mass electricity storage technology, the answer is going to be No. This is not acceptable for major metropolitan areas or any substantial commercial enterprise, especially a wireless communications or data server facility. (For example, there is not a single metals smelter anywhere in the world powered exclusively by wind or solar power.)

The increased emphasis on renewable energy sources is represented as an increase in the diversity of the generation portfolio, but the irony is that it might lead to less system stability and reliability, and not just because of the intermittency of wind power. The Department of Energy’s recent report on grid stability warns:

In regions with high penetration of VRE [variable renewable energy], sharper fluctuations in net load require increased flexibility (ramping up and down) from conventional sources. . . . Generator profitability could become a public policy concern if so much generation is financially challenged that the reliability or resilience of the BPS [bulk power systems] becomes threatened. New market structures may be necessary to reflect these market dynamics, particularly in an industry in which suppliers with high fixed capital costs and relatively low marginal costs often struggle to recover their long-run average costs. . . . Maintaining short-term reliability has grown more complex in light of higher levels of VRE. . . . Simple extrapolation of previous reliability trends is not prudent.12

Minnesota’s electricity sector is part of MISO—the Midcontinent Independent System Operator—that manages the wholesale electricity market and grid stability for all or part of 13 states stretching all the way down the Mississippi River basin to include Louisiana. (MISO is one of nine regional wholesale electricity markets in the continental U.S.) Electricity systems are required to maintain a minimum 15 percent reserve margin to allow for supply outages and surges in demand. In 2016 MISO maintained an average reserve of 18 percent; however, this was the lowest reserve margin of the nine regional wholesale power market systems. (By comparison, the Atlantic regional wholesale market has maintained a reserve margin between 25 and 33 percent over the last five years.) At present Minnesota obtains only a very small amount of its electricity from interstate purchases. The Department of Energy notes that regulatory mandates such as renewable portfolio standards (RPSs) are eroding baseload generating capacity and that the risk to grid stability could grow in the future: “Investments required for regulatory compliance have also negatively impacted baseload plant economics, and the peak in baseload plant retirements (2015) correlated with deadlines for power plant regulations as well as strong signals of future regulation. . . . States and regions are accepting increased risks that could affect the future reliability and resilience of electricity delivery for consumers in their regions.”13 While Minnesota’s RPS policies alone may not erode the region’s overall grid resiliency, they do mean that Minnesota could become more dependent on out-of-state electricity purchases in the future. Moreover, if the answer to the intermittency or low seasonal output of wind power is to build extra wind capacity for low output periods, the cost competitiveness of wind power will vanish.

Resource Tradeoff

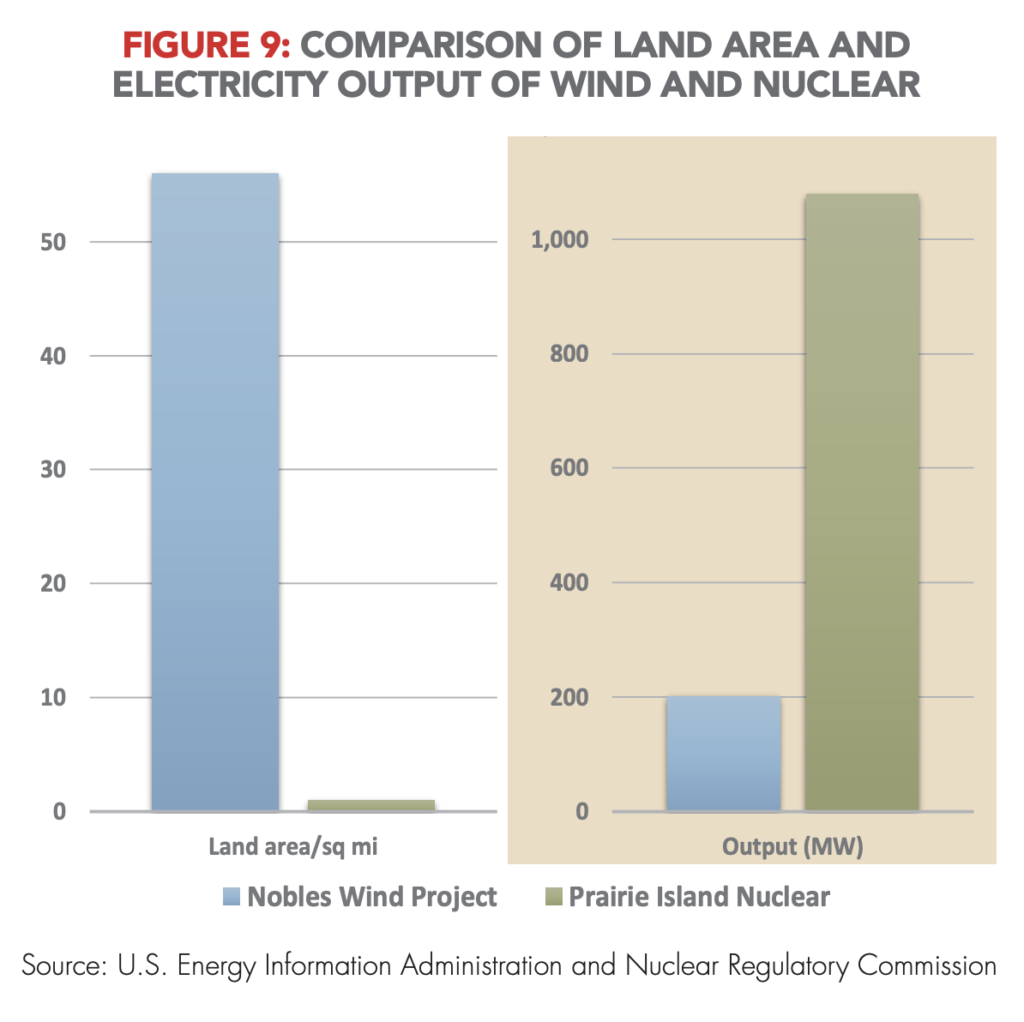

Another source of collateral damage from Minnesota’s RES is the resource tradeoffs involved in adding renewables. Traditional electricity generation plants require a much smaller land footprint than wind or solar. According to U.S. Department of Energy data for 2015, Minnesota’s Prairie Island nuclear power plant produced ten times as much electricity as the largest wind power “farm” in the state, the Nobles Wind Project that straddles Nobles and Murray Counties (7,375 gigawatts from Prairie Island versus 741 megawatts from Nobles Wind Project in 2015).14 The land and materials footprints of these two sources of power deserve a close comparison.

The Nobles Wind Project comprises 134 separate wind turbines spread over 56 square miles, and can produce 201 MW per hour of electricity under optimal wind conditions (compared to over 1 GW per hour by Prairie Island), which is at a wind speed of about 27 mph. The Prairie Island facility has a total land footprint of 578 acres—less than one square mile.15 (See Figure 9. The land footprint of Prairie Island is so small that it barely shows up on the scale.) A back-of-the-envelope calculation suggests that to replace Prairie Island’s capacity with wind power would require a land footprint of about 300 square miles.

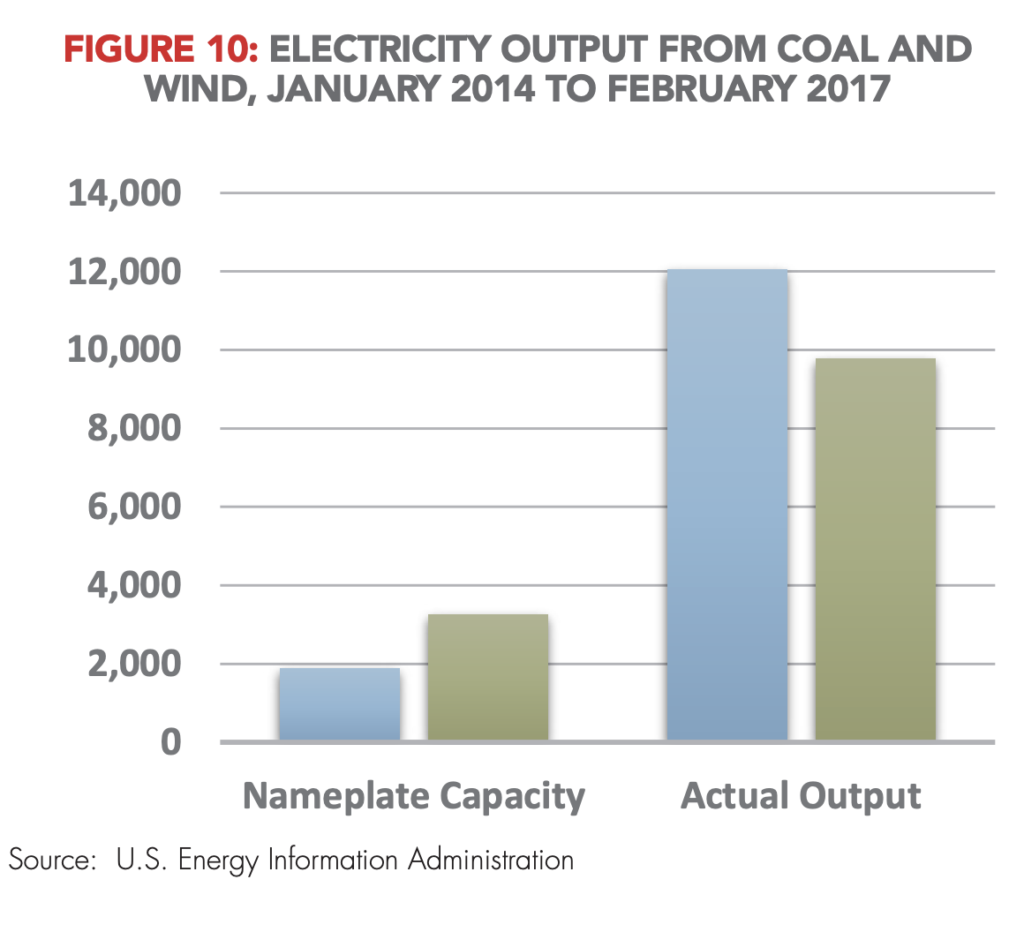

Figure 10 illustrates that while wind power on paper may be capable of producing more electricity than nuclear power (what is called “Nameplate” capacity in the electricity trade), in practice nuclear power produces more.

Conclusion

Legislation passed in 2017 reveals the Minnesota legislature understands the problem rising electricity prices pose to the state. Until this year, state energy goals largely ignored the cost involved in achieving them. But the Minnesota legislature recently enshrined one more energy goal into state statute that directs utilities to aim for electricity rates to “be at least five percent below the national average.”16 What this means is that the MPUC must now balance the cost of achieving the state’s various green energy goals with the cost.17

This report shows how Minnesota fails to come close to meeting near-term greenhouse gas emission reduction goals and how hopelessly unattainable it is to reach the longer-term goals. Considering these future goals are unattainable without great cost and hardship, the new goal to keep Minnesota electricity prices lower than the national average might appear to be in direct conflict.

Though a conflict may now exist among the goals, this rivalry will hopefully lead to a more measured and effective approach to reducing greenhouse gas emissions. Instead of rubberstamping a renewable energy project just because it might advance Minnesota’s green energy goals, moving forward the MPUC should now take greater care in evaluating alternatives and whether the project undermines competitive electricity rates.

The change is welcome, but will it be enough? Minnesota electricity rates are now higher than the nation’s, but substantial investments in new wind and solar have already been approved by the MPUC, despite no increase in demand. Getting back to a proper balance will almost certainly require further updates to state law.

About the authors: Steven F. Hayward is the senior resident scholar at Institute of Governmental Studies, University of California at Berkeley and author of the 2011 Almanac of Environmental Trends. Peter J. Nelson was vice president and senior policy fellow at Center of the American Experiment at the time of publication. He is now senior advisor at Centers for Medicare and Medicaid Services.