Minnesota doesn’t need higher gas taxes

Over the next two years, Minnesota’s state government is forecast to take $1.5 billion more from the state’s taxpayers than it needs to cover its projected spending. The question of what should happen to this surplus is likely to dominate the upcoming session at the state capitol. Should the money fund extra spending? Should it be given back to the people it is to be taken from? Should we hold our horses and wait to see how closely the forecast matches the reality?

Incredibly, these three options do not exhaust the possibilities being discussed for the state’s taxes. Even with this extra cash slopping around in state government coffers, incoming Governor Tim Walz still seems set on trying take more money off of Minnesota’s taxpayers by hiking the gas tax.

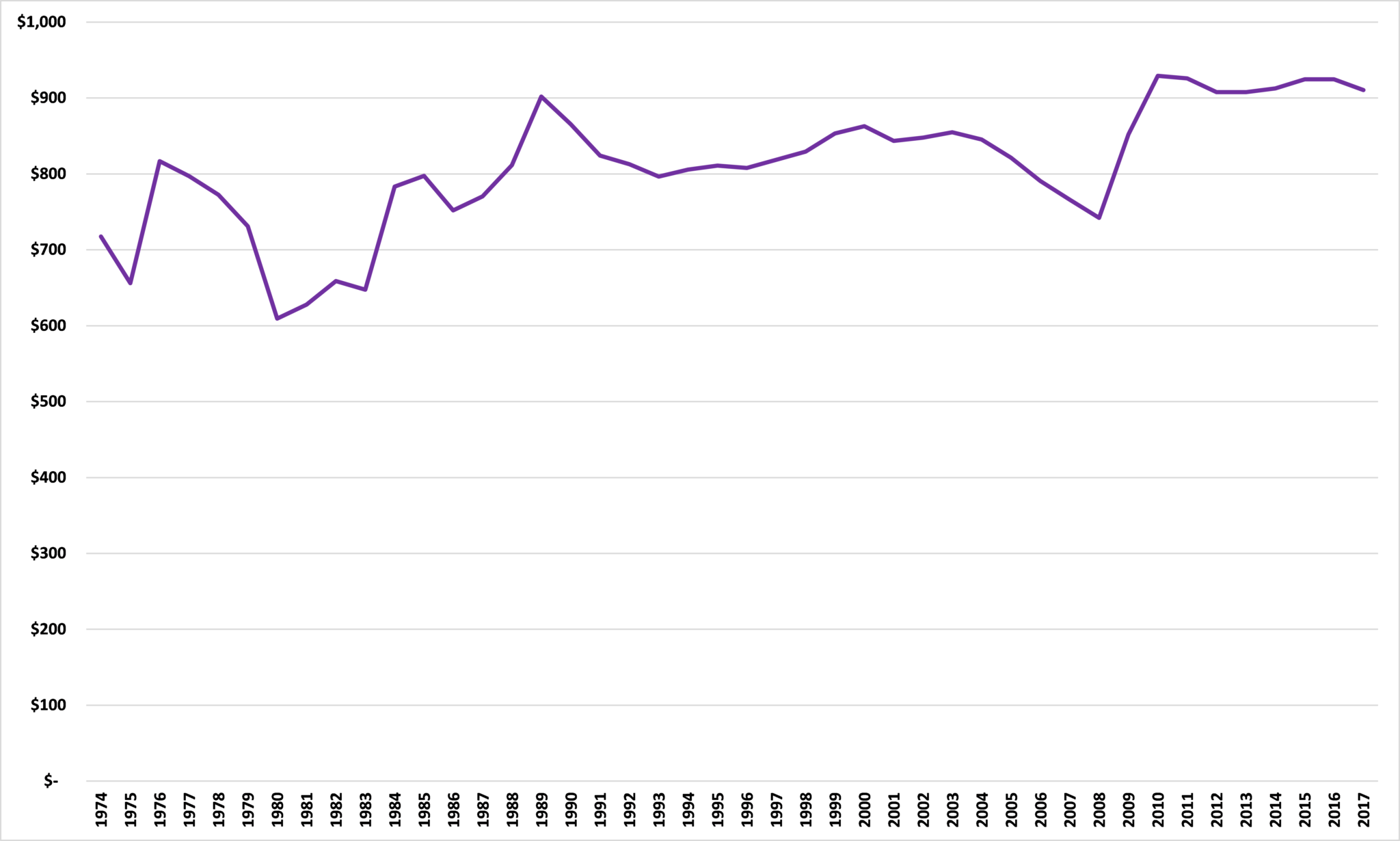

Data from the Minnesota Department of Revenue shows that, in real terms, Minnesota’s Fuel Excise Tax revenues in 2017 were higher than in 38 of the last 44 years. Indeed, eight of the top ten years for revenue since 1974 have been in the last decade.

Figure 1: Motor Fuels Excise Tax revenues, billions $2017

Source: Minnesota Department of Revenue

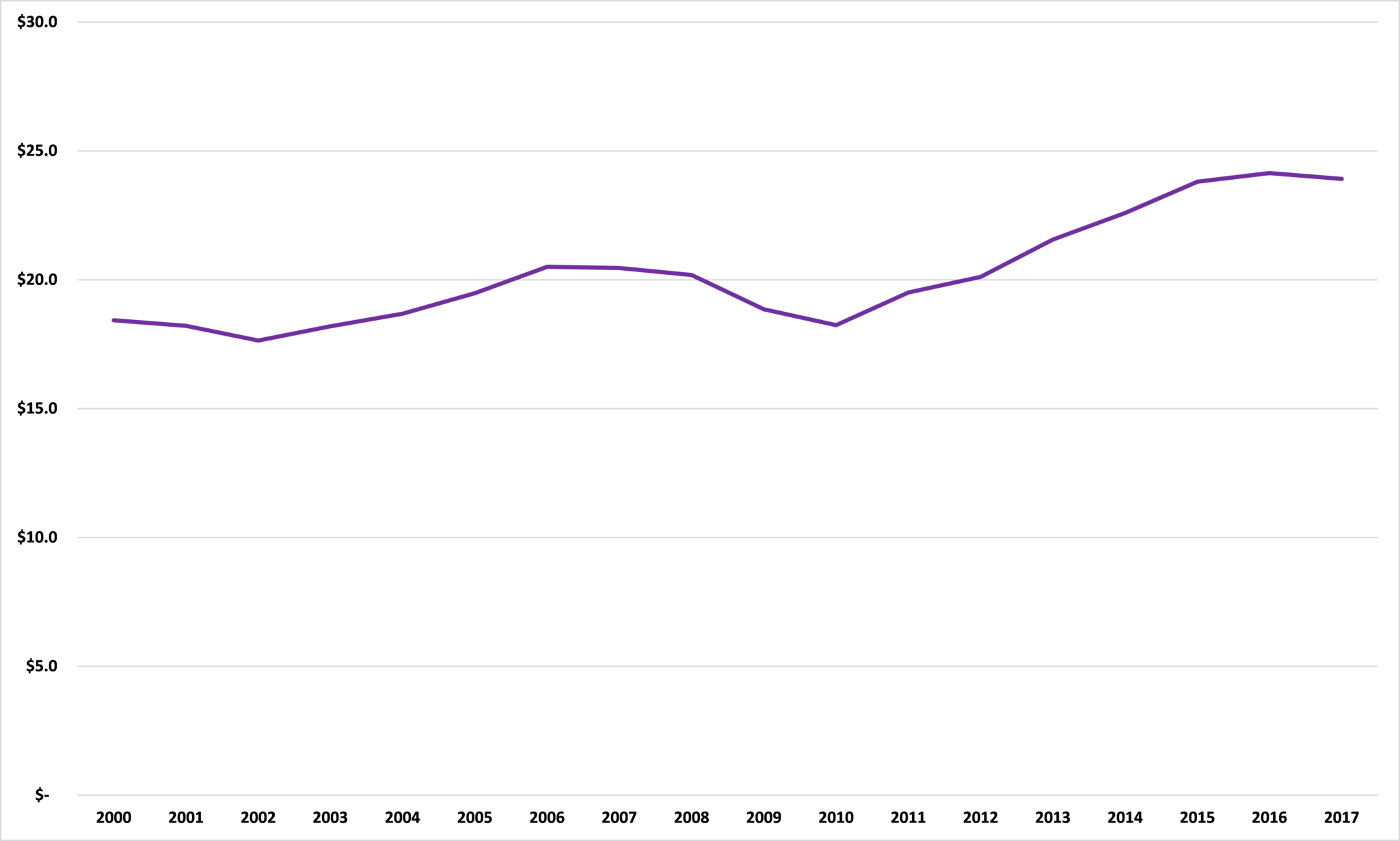

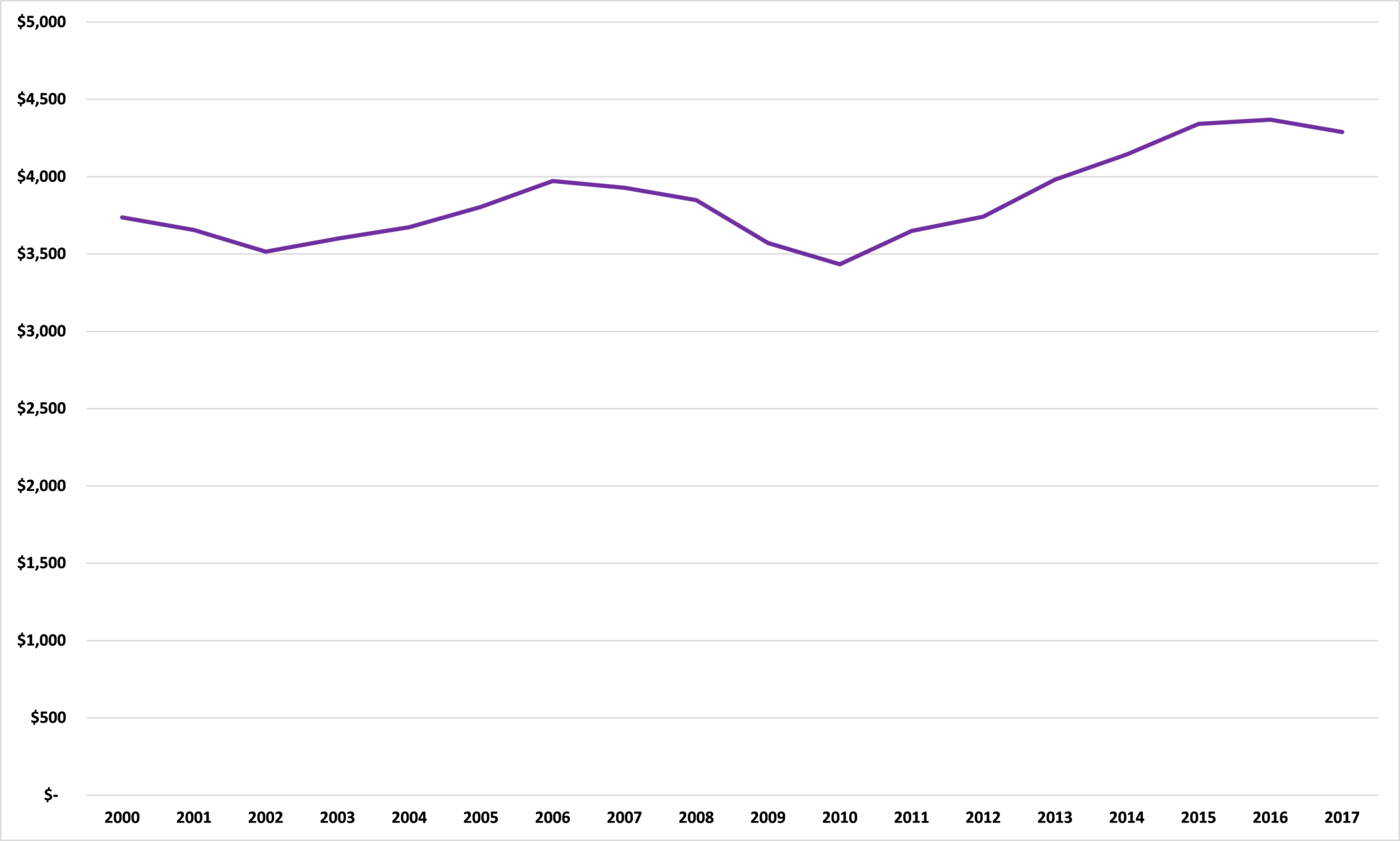

That same data also shows that state tax revenues more broadly have risen by 31% in real terms since 2010 (Figure 2) and in real per capita terms by 25% (Figure 3) over the same period.

Figure 2: Total State Tax Collections, billions $2017

Source: Minnesota Department of Revenue

Figure 3: Total State Tax Collections per capita, $2017

Source: Minnesota Department of Revenue

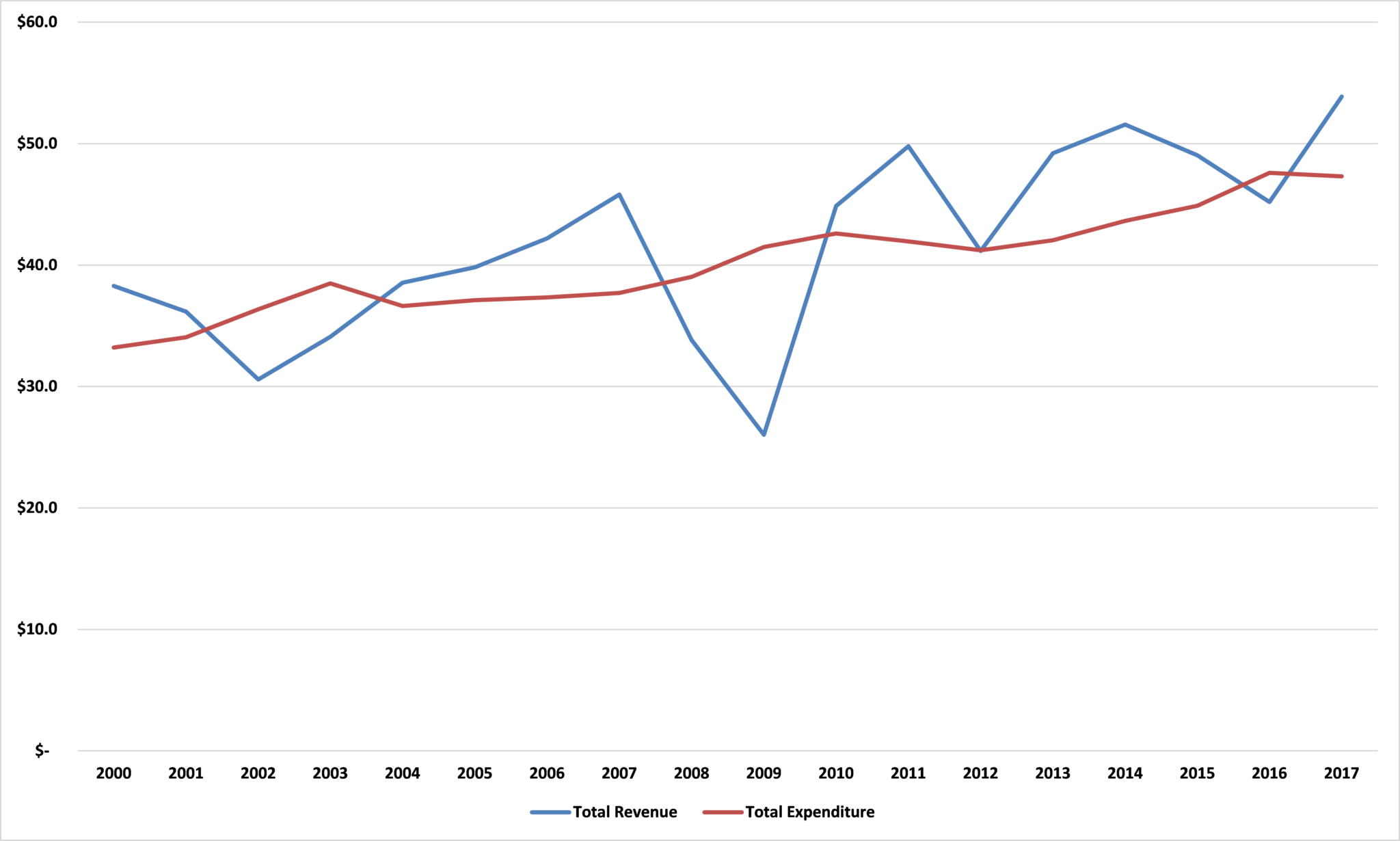

This is complicated a little by federal taxes and spending. Using Census Bureau data, Figure 4 shows that, in real terms, the Minnesota state government’s Total Revenue in 2017 was higher than any year previously. Our state government’s Total Expenditure in 2017 was higher than in all but one previous years.

Figure 4: Minnesota Total Revenue and Total Expenditure, billions $2017

Source: Census Bureau

In terms of revenue the politicians in Saint Paul have never had it so good. Why, then, are they pleading poverty and planning to take more of their citizen’s money from them? If they are having trouble funding a core competency such as roads, that would seem not to be the result of a shortage of revenue but of a mistaken allocation of the revenue they have. With all the cash they get from us and the surplus they are projected to get, there is no excuse for soaking the state’s citizens afresh to pay for something so basic.

John Phelan is an economist at the Center of the American Experiment