Minnesota ranks 40th in the US for economic freedom

Last week saw the publication by the Fraser Institute of their Economic Freedom of North America 2017. This “measures the extent to which the policies of individual provinces and states were, in 2015, supportive of economic freedom, the ability of individuals to act in the economic sphere free of undue restrictions.”

Economic freedom

In the report, economic freedom is defined as

Individuals have economic freedom when (a) property they acquire without the use of force, fraud, or theft is protected from physical invasions by others and (b) they are free to use, exchange, or give their property as long as their actions do not violate the identical rights of others. Thus, an index of economic freedom should measure the extent to which rightly acquired property is protected and individuals are engaged in voluntary transactions.

Research shows that economic freedom is positively correlated with per-capita income, economic growth, greater life expectancy, lower child mortality, the development of democratic institutions, civil and political freedoms, and other desirable social and economic outcomes.

The results

So what did the results show?

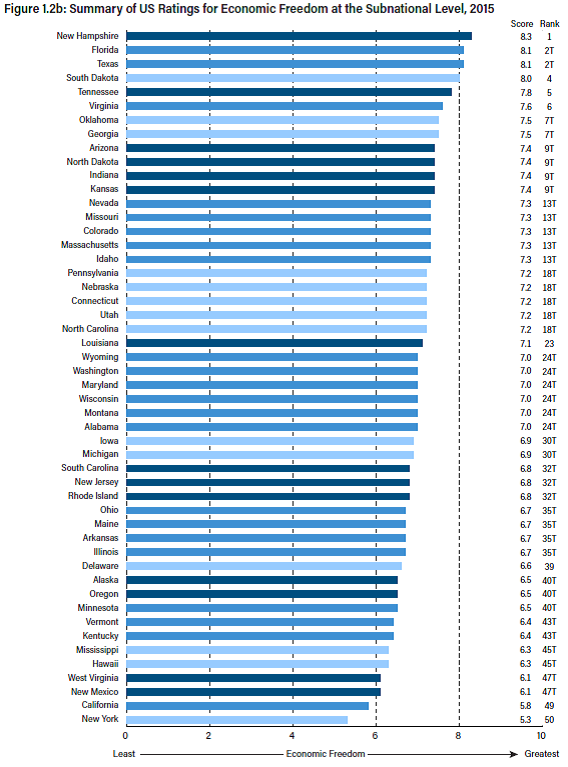

In the United States, the most economically free state was New Hampshire at 8.3, followed at 8.1 by Florida and Texas. South Dakota is fourth at 8.0. The least-free state was New York at 5.3, following California at 5.8. New Mexico and West Virginia were tied for 47th at 6.1.

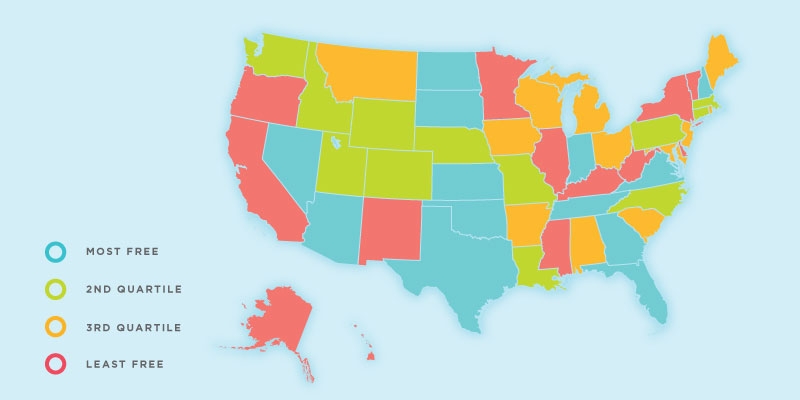

As Figures 1 and 2 show, Minnesota was in the bottom quartile, ranked 40th. This was an improvement on last year.

Figure 1: States by economic freedom, 2015

Source: The Fraser Institute

Figure 2: Summary of US Ratings for Economic Freedom at the Subnational Level, 2015

Source: The Fraser Institute

Our taxes are to blame

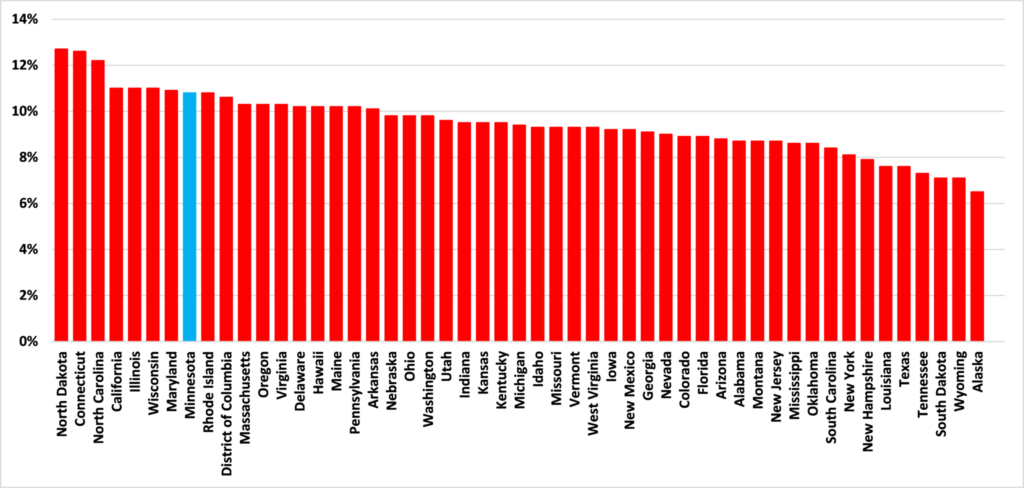

This score was primarily driven by our state’s high rates of personal and corporate taxation. This will come as no surprise. As we find in our new report, The State of Minnesota’s Economy: 2017, Minnesota is one of the most heavily taxed states in the union.

As a share of personal income, state-local taxes are higher in Minnesota than in all but seven other states, as Figure 3 shows. Minnesota is one of the 43 states to have its own income tax, but the top rate – 9.85% on incomes over $156,911 – is higher than anywhere else apart from California, Maine, and Oregon. Equally significant, perhaps, is the fact that Minnesota’s lowest income tax rate of 5.35% is higher than the highest tax bracket in 23 states.

Figure 3: State-Local tax burdens per capita as a percentage of income

Source: The Tax Foundation

The Tax Foundation ranks Minnesota 46th out of the 50 states for its business tax climate. Minnesota imposes a deduction schedule for natural resource depletion on top of the federal one, and is one of only eight states to have an Alternative Minimum Tax on corporations. These add another layer of compliance difficulties beyond the federal. Furthermore, as Figure 4 shows, while we exempt items like food and clothing, we have the eighth highest state sales tax in the country.

Figure 4: State Sales Tax rates

Source: The Tax Foundation

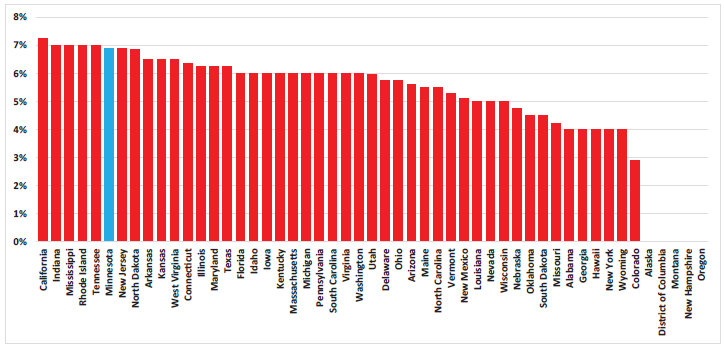

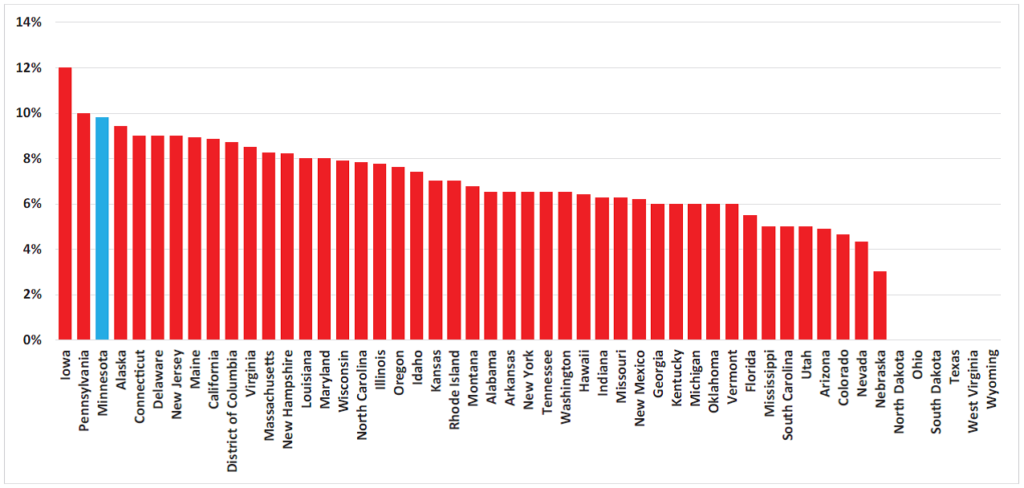

More importantly perhaps, Minnesota’s top rate of Corporate Income Tax is 9.8 per cent. As Figure 5 shows, this is the third highest in the U.S. Only Iowa (12 percent) and Pennsylvania (9.99 percent) have higher rates. Evidence shows that corporate income tax rates are a big influence in foreign investment decisions.

Figure 5: Top Rates of Corporate Income Tax

Source: The Tax Foundation

John Phelan is an economist at the Center of the American Experiment.