Texas is increasingly at risk of winter blackouts

It has been nearly three years since Winter Storm Uri caused more than 24 million Texans to suffer through four days of rolling power outages due to inadequate electricity supplies.

Unfortunately, the data show Texas residents served by the Electric Reliability Council of Texas (ERCOT) are still vulnerable to winter power outages, and this threat will become more pronounced in the years to come because Texas is not building more dispatchable power plants despite surging demand.

The lay of the land

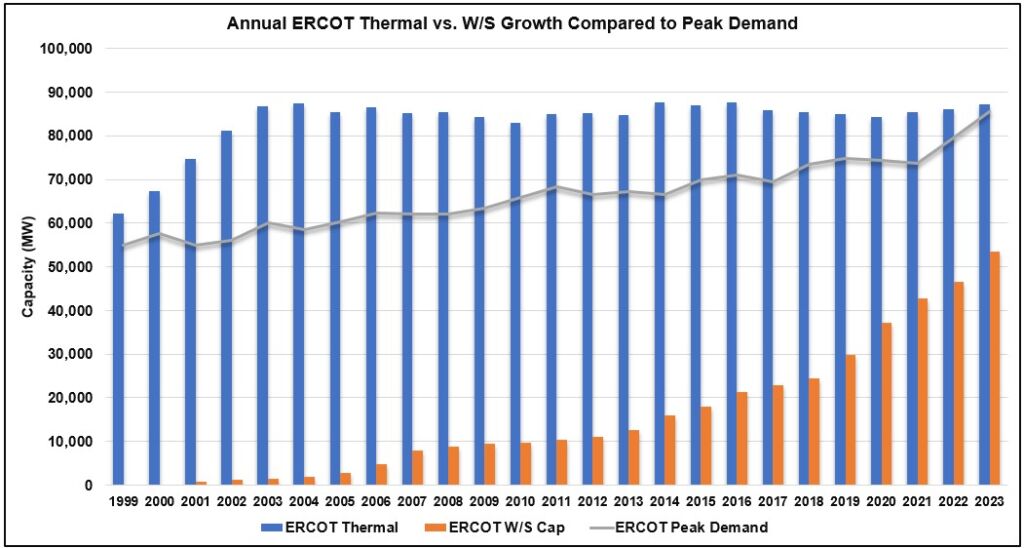

ERCOT is vulnerable to power outages because electricity demand has risen by 40 percent since 2003, but data from the Regional Transmission Organization (RTO) show there has been no net growth in dispatchable thermal generating capacity since that time because natural gas capacity additions have been offset by coal plant closures.

The graph below shows ERCOT’s expected peak demand, which occurs in the summertime, with the black line and the cumulative installed capacity of the state’s thermal resources (i.e., natural gas, coal, and nuclear power plants) in blue. The state’s combined wind and solar capacity is shown in orange.

Essentially, ERCOT is attempting to satisfy an additional 30,000 megawatts (MW) of demand by building over 50,000 MW of wind and solar, which have an inconvenient habit of not showing up for work when they are needed most. This habit is one reason why Texas issued at least ten conservation appeals asking residents to reduce electricity usage in the summer of 2023.

ERCOT’s reliance upon wind and solar to meet its growing peak electricity demands is a key reason why the North American Electric Reliability Corporation (NERC) ‘s Winter Reliability Assessment warns the region will face reserve shortage risks during high net load hours this winter.

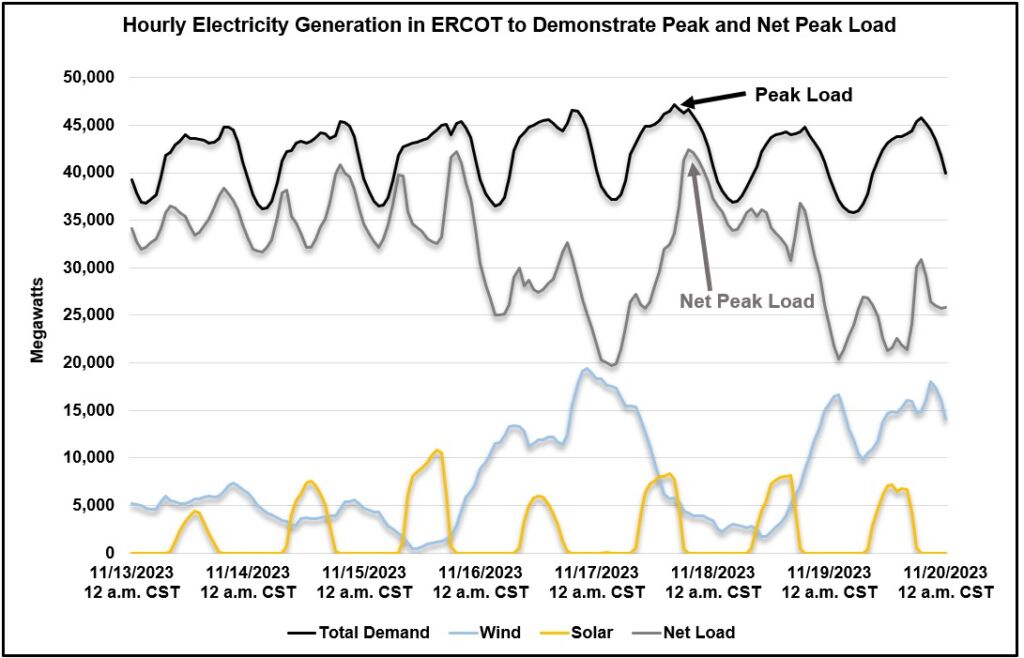

For those unfamiliar with the term, net load refers to the demand for electricity minus the contribution of wind and solar, which you can see in the grey line in the graph below. Net peak load occurs when demand is highest, but output from wind and solar falls to their lowest points.

If Environmental Protection Agency regulations or other public policies force the grid to become increasingly reliant upon wind, solar, and battery storage, then meeting net load will become increasingly difficult because these are, by definition, times when intermittent wind and solar generators are not performing well.

ERCOT faces particular challenges meeting winter net load because this peak load occurs at night when temperatures are lowest, causing a surge in demand for electric heating. This nocturnal power demand means the growing solar capacity on the system will be unable to generate electricity when it will be needed most, leaving the system dependent on wind generation and dispatchable power plants to keep the lights on.

Struggling with supply

ERCOT has not added any net dispatchable capacity since 2013 because its market design is an energy-only market, which only compensates companies for the power that is produced, and it does not properly value the capacity difference between gas and coal generators and wind and solar generators.

Furthermore, Texas does not require utilities to keep enough backup capacity online to make sure there are always enough reliable power plants available to meet electricity demand when the wind isn’t blowing, or the sun isn’t shining. In fact, the market structure in Texas specifically incentivizes generators to exit the market.

Such a market design might work in a world where all generators had access to the same revenues and provided the same reliability value to the grid, but subsidized wind and solar generators have reduced wholesale power prices in Texas so much that they have pushed reliable power plants off the grid without replacing their reliability attributes.

This isn’t a bug of the ERCOT market; it is a feature. In a 2018 report by the WindSolar Alliance of Texas, the organization bragged about the parasitic effect these electricity generators have on the revenues of more reliable power plants:

This is just the beginning. Texas continues to add more wind every year, and ERCOT has estimated that the state could put online 13 GW of solar by 2030. This will ultimately mean more hours where coal and gas plants are not operating, and more retirements of conventional generation. [emphasis added]

As the subsidies in the Inflation Reduction Act (IRA) incentivize more wind and solar deployment in Texas, they will make it increasingly difficult for the remaining reliable power plants on the ERCOT grid to earn enough revenue to continue operating in the years to come, and they will disincentivize the entry of new dispatchable power plants into the market. All of these factors make the state increasingly vulnerable to power shortages.

Growing winter demand

Texas is burning the reliability candle at both ends by limiting the amount of reliable power plant capacity it can support due to its market structure while the state is simultaneously experiencing an increase in electricity demand.

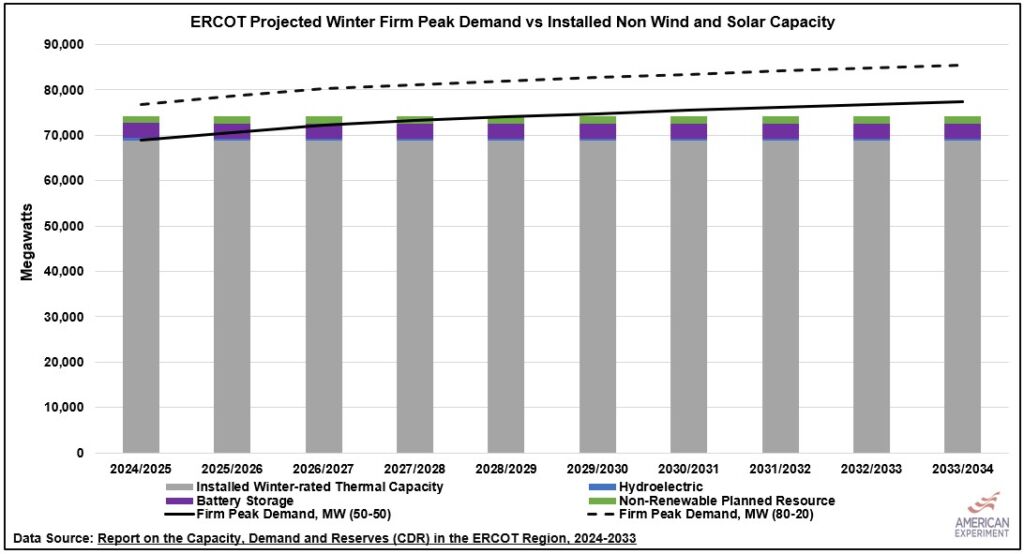

ERCOT’s May 2023 Report on the Capacity, Demand and Reserves (CDR) in the ERCOT Region, 2024-2033 shows that it expects significant winter peak load growth in the coming years fueled by a combination of industrial growth and a growing demand for electric heat as the state continues its current population boom. Unlike much of the Midwest, 62 percent of homes in Texas use electricity to heat their homes, while only 34 percent use natural gas.

The graph below uses data from page 25 of the report, and it shows the anticipated winter peak load growth in ERCOT during 50-50 storms (those that can be expected to happen every year) and 80-20 storms (those that can be expected to happen every five years) and compares it to the amount of non-wind and solar capacity available to meet these projected peak winter demands.

By the winter of 2024-2025, the data suggests that Texas will not be able to meet its winter peak demand during an 80-20 event, meaning it will depend upon the contribution of intermittent wind resources to prevent rolling blackouts. By the winter of 2029-2030, ERCOT will not be able to meet its 50-50 winter peak load projection without the contribution of wind resources.

For context, Winter Storm Uri was 99/1 storm, and was expected to create a demand for 76,000 MW of power before the rolling blackouts were initiated. This means that by 2031/2032, ERCOT expects to have the same electricity demand every year as Texas experienced during that once-in-a-100-year storm. As a result, the demand experienced during Winter Storm Uri is a window into the future.

Only half measures

Unfortunately, Texas doesn’t control the flow of federal dollars out of Washington to wind and solar projects, leaving it with few good options to improve its reliability situation. This has resulted in a series of ad-hock half-measures to shore up the reliability of its grid, all of which are eerily similar to the policy duct tape currently holding California’s grid together.

One of these half measures was a series of contracts offered to stakeholders to bring 3,000 MW of mothballed coal and natural gas plants back into service to provide additional dispatchable-capacity cushion this winter, which sounds a lot like the Reliability Must Run (RMR) payments California makes to natural gas power plants to ensure they are able to generate electricity during grid emergencies.

Another half measure is Proposition 7, a newly passed state ballot initiative that will provide low-interest loans to companies that build new natural gas power plants. However, University of Houston Energy Fellow Ed Hirs said the proposition won’t make a difference to the reliability of the Texas power grid because providing a company with financing does not guarantee the owner of the power plant will make any revenue to cover the costs of operating the plant. This is especially likely to be true due to the renewed subsidies in the IRA stimulating more wind and solar development in the ERCOT markets.

While these policies have their shortcomings, they are good in the sense that they acknowledge the potential for capacity shortfalls on the system. They also serve to highlight the reality of a failing system — one that routinely fails to ensure consistently reliable and affordable electricity. Rather than offering special contracts to restart shuttered power plants or subsidizing new plants, Texas should get to work fixing the ERCOT market, so they don’t discourage reliable generators from operating on the system in the first place.

What’s the solution?

Fixing the problems inherent with ERCOT will be a difficult political lift, even in Texas. While wind and solar advocates will propose unserious options, including building more wind, solar, battery storage, and transmission lines, a few of the more realistic options are listed below.

Enact a firming requirement: Enacting a strong “firming requirement” would require new and existing electric generators to guarantee a certain amount of power generation capacity, including wind and solar generators, would be made available to the grid during peak periods. This policy would essentially require intermittent generators to pay their fair share to keep the lights on and would likely face the least resistance in Austin.

Promulgate a Minimum Offer Price Rule (MOPR): A MOPR could be enacted to raise the bids submitted into the energy market by wind and solar generators to negate the value of the federal Investment Tax Credits and the Production Tax Credits. This would help reduce the prevalence of negative prices in ERCOT and the market distortions caused by the subsidies.

Create a Capacity Market: Creating a capacity market would end ERCOT’s experiment with an energy-only market. Under this market structure, ERCOT would estimate how much power would be needed to meet its peak load obligations, and power plants would submit bids into a capacity auction to meet this peak demand and receive payments for being online during those periods. While this option would help shore up the grid, it would also be very expensive.

Go back to monopolies: If ERCOT can’t fix the reliability problems and the state suffers another devastating blackout like Winter Storm Uri, Texans may throw up their hands and abandon the regional transmission organization concept altogether in favor of returning to a cost-of-service monopoly model. As Meredith Angwin pointed out in her fantastic book, Shorting the Grid, the key advantage to this course of action is that there is more accountability for reliability.

ERCOT and Texans are running out of time to enact serious reforms that will fix the oncoming winter reliability issues. The solution is simple: build new dispatchable power plant capacity, but given the structure of the ERCOT market, this is easier said than done.