The state and local tax deduction allows high tax states to pass some of the burden on to others. It should be ended.

During last year’s presidential election campaign, Hillary Clinton promised $1.65 trillion in additional spending over the next ten years on infrastructure, health care, education, and other federal budget items. She claimed this wouldn’t “add a penny” to the national debt because ‘the rich‘ were going to pay for it all.

When rich Minnesotans voted for higher taxes

And, in an act of supreme selflessness, some of the richest counties in Minnesota voted for this program. In Hennepin County, which has the highest personal income of any county in our state, Mrs. Clinton got 64% of the vote. Indeed, the odds of Minnesotan counties with above average personal incomes voting for Mrs. Clinton were 2.5 times higher than the odds of counties with below average personal incomes doing so.

Happily, the GOP tax plan offers some good news for these folks. It proposes eliminating the state and local tax deduction (SALT). This lets tax filers deduct the taxes they pay to state and local governments from the total of their income calculated for federal tax purposes. A Minnesotan earning $1 million and facing the state income tax of 9.85% and the federal income tax at a rate of 39.6% would be able to deduct the $100,000 tax liability to the state of Minnesota from their income assessed for federal taxation. That would fall to $900,000. The filer’s federal tax liability is $40,000 less than it would have been without the SALT deduction.

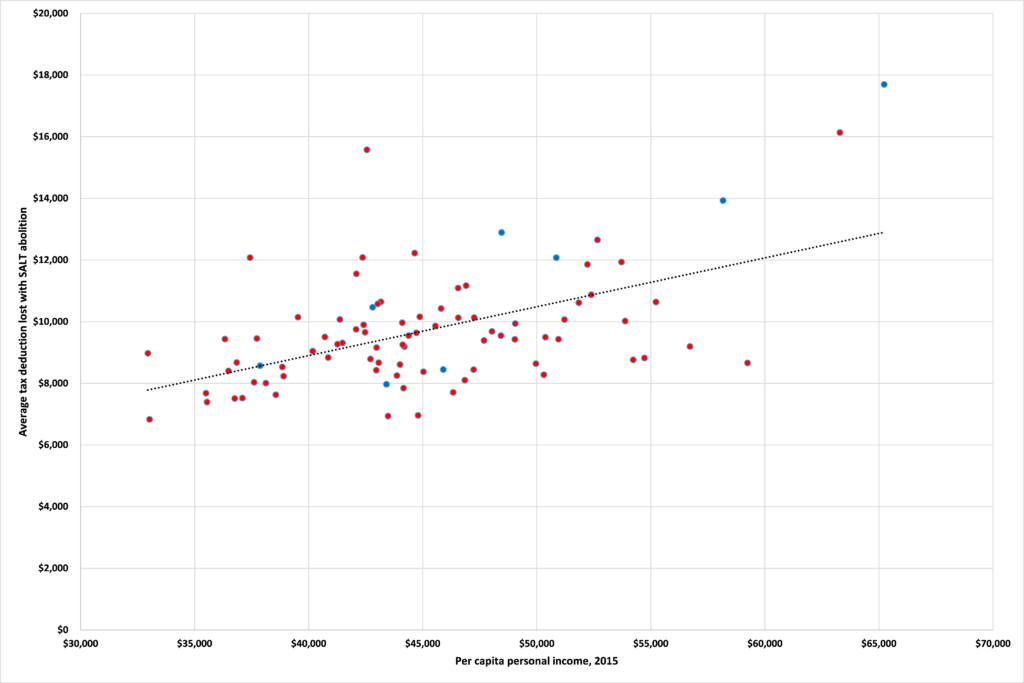

The deduction primarily benefits those on high incomes in high tax states, like Minnesota. As Figure 1 shows, counties with higher per capita personal incomes would lose most from the abolition of the SALT deduction (the blue dots are counties which voted for Mrs. Clinton).

Figure 1 – Per capita personal incomes and average losses due to abolition of SALT deduction by county

Source: Bureau of Economic Analysis and Fox9

In short, the abolition of the SALT deduction will disproportionately affect households with higher incomes. It will raise their federal income tax liability.

So higher federal taxes are…bad?

Surely politicians who were campaigning last November for higher federal income taxes on the rich should be supportive of this measure? Oddly, no.

Governor Mark Dayton said that the repeal of the state and local tax deduction is “one of the most offensive proposals” in the GOP plan. He called it “shamefully biased against lower-and middle-class families.” First District DFL Rep. Tim Walz says that “The GOP proposal to end the state and local tax deduction would hamper the ability of our local governments to provide essential services, such as public education, and would likely result in a tax increase for the middle class…It is a non-starter for me.”

Why the sudden change of heart?

So higher federal taxes are…good?

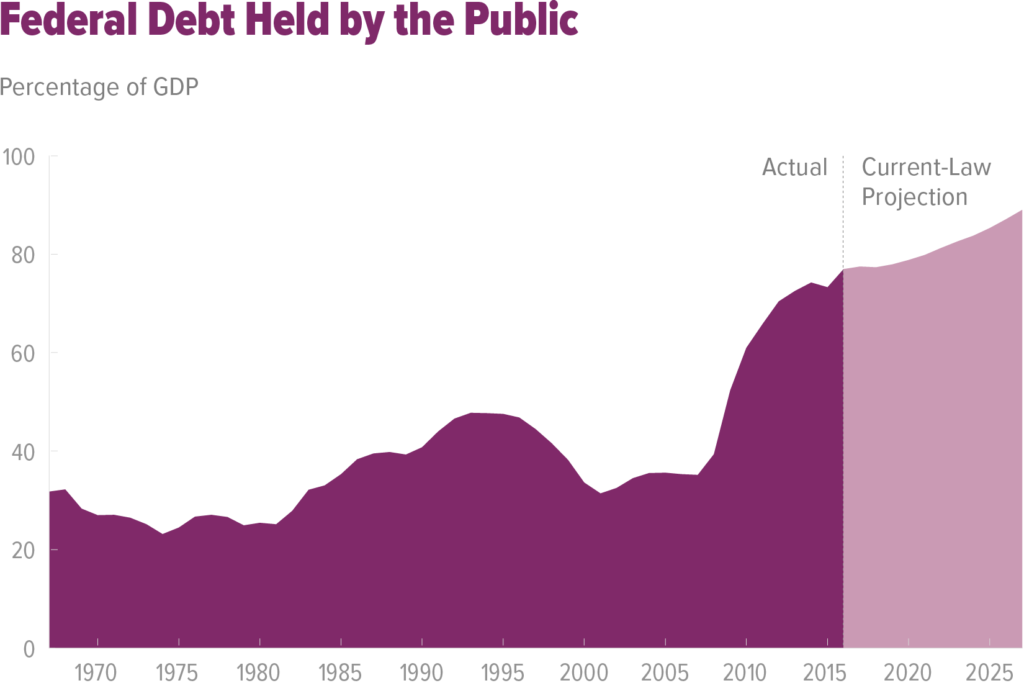

The federal government should not be looking to raise income taxes. The CBO projections for federal spending and debt, as seen in Figure 2, show that only spending restraint will balance the federal government’s books.

Figure 2 – Federal debt held by the public

Source: Congressional Budget Office

But there would be benefits from abolishing the SALT deduction. At present, the deduction allows states to get $1 in state income-tax revenue at a real cost to their taxpayers of less than $1. As a result, residents in lower tax states subsidize those in higher tax states via the federal treasury and SALT. If people want to vote for higher taxes that is one thing. But if they do, they should pay them and not expect others to pick up the tab. Abolishing the SALT deduction will internalize the burden of high state taxes more fully. This will enable Minnesota’s voters to assess more accurately just whether or not they want to pay those higher taxes.

Abolishing the SALT deduction will face voters in high tax states with the full fiscal cost of their decisions. It might be one of the few worthwhile tax hikes.

John Phelan is an economist at Center of the American Experiment.