Who will pay for the 70 percent gas tax hike? You will.

One of the great myths of public policy is that politicians decide who pays a tax. They might call it something like the ‘Medical Provider Tax‘ in the expectation that medical providers will pay it, but whether or not they do or pass it on to medical consumers instead is outside of the politician’s control. Likewise, just because it is called the ‘corporate tax’ does not mean that corporations actually pay it.

Taxes: Elasticity and incidence — who pays?

The crucial concept is, in the jargon, ‘price elasticity of demand‘. If demand is said to be price ‘elastic’, this means that it is more sensitive to price changes. A price cut/increase of X percent will yield an increase/fall in the quantity demanded greater than X percent. By contrast, where demand is said to be price ‘inelastic,’ it is less sensitive to price changes. In this case, a price cut/increase of X percent will yield an increase/fall in the quantity demanded less than X percent.

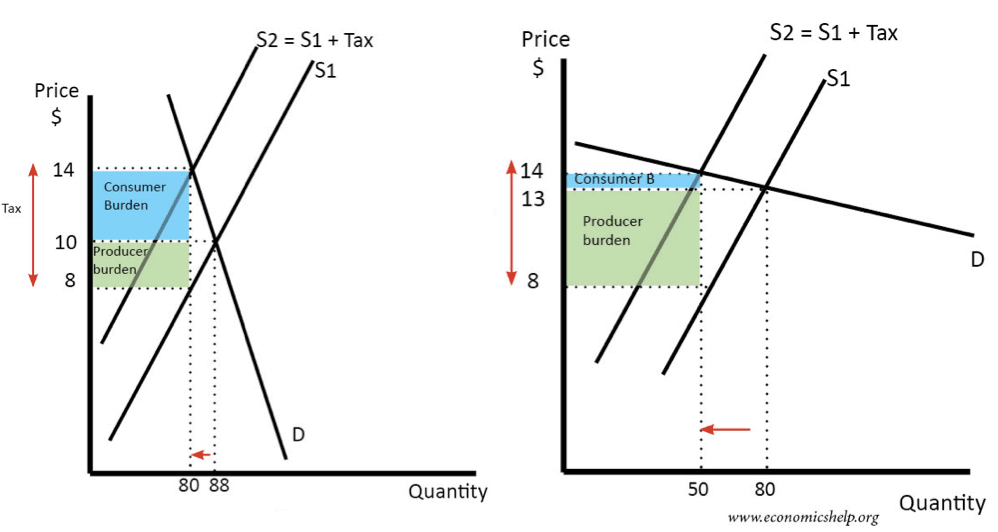

The charts below illustrate this. In the left hand chart, demand is pretty inelastic. An increase in price of 40.0 percent ($10 to $14) yields a fall in the quantity demanded of 9.1 percent (88 to 80). If we divide the percentage change in quantity demanded by the percentage change in price we get an elasticity of demand of 0.23. As this ‘coefficient of price elasticity of demand’ is less than 1, we know that demand is price inelastic. In the right hand chart, demand is pretty price elastic. Here, an increase in price of 7.7 percent ($13 to $14) yields a fall in the quantity demanded of 37.5 percent (80 to 50). The ‘coefficient of price elasticity of demand’ here is 4.87 — greater than 1 — so we know that demand is fairly price elastic.

We can also see how these elasticities determine the ‘incidence‘ of a tax, i.e. who really bears the burden.

Placing a tax on a good or service shifts the supply curve to the left. This is because, for producers, the tax works like an increase in the cost of production. It now costs them $6 dollars more in this case — the amount of the tax — to produce each unit. They must send this amount to the government in tax for each unit sold. Because of this, at any given price, a smaller quantity will be supplied.

This shift in the supply curve increases the equilibrium price from $10 to $14 in the inelastic case and from $13 to $14 in the elastic case. The quantity demanded falls from 88 to 80 and from 80 to 50 respectively. We can calculate the new tax revenue in each case; $480 ($6 per unit x 80 units) with inelastic demand and $300 ($6 per unit x 50 units) with elastic demand.

But how is this split between the producer and the consumer? Remember that, in the inelastic case, the price paid by the consumer went up from $10 to $14 per unit. That $4 multiplied by 80 units means that consumers paid $320 of the new tax, or 66.7 percent. In the elastic case ($1 per unit multiplied by 50 units) it means that consumers paid $50 of the new tax, or 16.7 percent.

There are two important lessons here for public policy.

First, taxing goods or services where demand is price inelastic — like cigarettes, you’re addicted — will generally raise more revenue than taxing goods or services where demand is price elastic.

Second, the burden of taxes on goods and services with inelastic demand will generally fall on consumers to a greater extent than where demand is elastic — like newspapers, you can read it all online.

Is gas ‘elastic’ or ‘inelastic’? — who pays?

Which brings us to Minnesota’s proposed 70 percent gas tax hike. Who will bear the burden of this: gas sellers or buyers?

As we’ve seen, this depends on whether or not the demand for gas is price elastic or inelastic. Will the gas tax hike simply lead people to buy less gas? Or will they have to suck it up, spend more on gas, and less on other things?

This depends on what your alternatives are. If you live in the city cutting your gas consumption might be a viable option, you can use mass transit. But if you live in Koochiching County, for example, where this option doesn’t exist, your alternatives are to just stay home or cut back on other things. Our urban dweller’s demand for gas will be much more price elastic than that of the guy in Big Falls so he will bear less of a burden from the tax.

John Phelan is an economist at the Center of the American Experiment.