The government doesn’t need to regulate your six pack of Coors Light

Back in June 2008, the US Department of Justice approved the merger between mega-brewers SAB Miller and Molson Coors. But why did these businesses need to get the permission of the DOJ in the first place? The answer is monopoly.

Monopolies in economics

In economics, monopolies have three characteristics, First, there is one producer and many buyers. Second, there is a lack of substitute products. Third, there are barriers to entry. In this case, the sole producer could raise their prices knowing that there would no competition and their customers couldn’t switch to another product.

In the late nineteenth century, concern about this in the United States led to the passing of an extensive body of ‘Anti-Trust’ legislation (trust being the term used for monopoly). These laws remain in place, as Bill Gates can tell you. They give the federal government the power to break up companies deemed to be monopolies (as in Microsoft’s case) or to block mergers that might create monopolies, as in the case of SAB Miller and Molson Coors.

Monopolies in Coors Light

A forthcoming paper, ‘Understanding the Price Effects of the MillerCoors Joint Venture‘ by economists Nathan Miller and Matthew Weinberg, explores the effects of the 2008 merger. In assessing the effects of a merger, they argue, the DOJ applies a theory of unilateral effects. This is the assumption that the merged firm may increases its prices but that competitors respond only indirectly. For a number of reasons, the DOJ decided that prices were unlikely to rise as a result of the merger and allowed it on that basis.

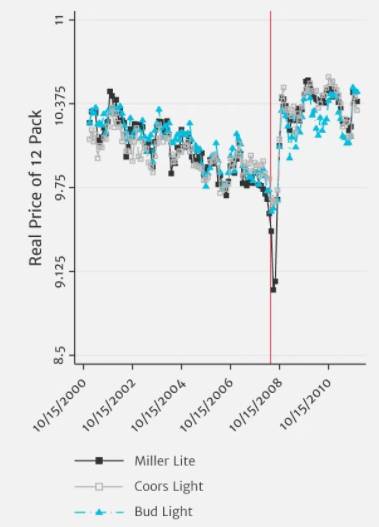

That was wrong, Miller and Weinberg argue. They look at the average price of a 12-pack of bestselling beer for the three firms: the two merging firms, Millers and Coors, and the industry leader, Anheuser-Busch/Inbev (ABI). They find that, for at least seven years before the merger, inflation-adjusted prices steadily declined. But after the merger, prices increased by about 8%. Furthermore, prices for ABI’s Bud Light increased by nearly the same amount. The same applies to the most popular package sizes and brands sold by Miller, Coors, and ABI bedsides these three.

Figure 1: Average price of a 12 pack

Source: Microeconomic Insights

Never let it be said that economists don’t study anything useful.

Not so fast…

Miller and Weinberg conclude that, if the objective was to prevent price increases for consumers, the MillerCoors merger should not have been approved. But think again about the characteristics of monopoly.

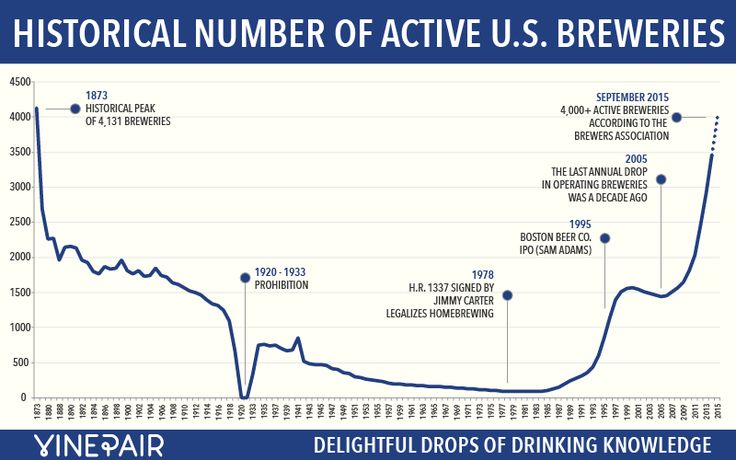

First, even after the merger of these two mega-brewers, there are still very many other producers. Indeed, as Figure 2 shows, in 2015 there were more than 4,000 breweries in America, approaching the previous peak of 4,131 in 1873.

Figure 2: Number of breweries in the United States, 1873 to 2015

Source: Vinepair

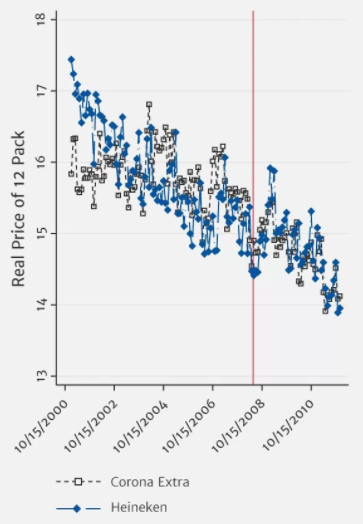

Second, there is no lack of substitutes for Coors Light or Miller Light. If you doubt this, just go to your nearest liquor store. Indeed, Miller and Weinberg also report data for Corona Extra and Heineken, pretty close substitutes for Coors Light and Miller Light. For these, prices did not increase and roughly follow their pre-merger trends.

Figure 3: Average price of a 12 pack

Source: Microeconomic Insights

Third, while there are barriers to entry in the form of regulations and financing constraints, many people find these easy to overcome, as Figure 2 illustrates.

There is no reason to doubt Miller and Weinberg’s finding that MillerCoors and ABI beers got more expensive after the MillerCoors merger in 2008. But this does not make a case for government action.

Consumer and producer surplus

Given the existence of so many other producers and substitute products, the people who paid the extra 50c per six pack were willing to. Assume that each bottle of Coors Light costs 40c to produce, sells for $1, and that a consumer would pay up to $2 – their ‘reservation price’ – for the bottle. Above that they’d say “The hell with this” and buy a Heineken instead. In this case, what economists call the Producer Surplus, ie profit, is 60c (sale price – cost). The Consumer Surplus is $1 (the reservation price – the sale price). When the price of MillerCoors beers rose after the merger, all that happened was that some share of Consumer Surplus was shifted to the producer. But, even in this case, the consumer was getting the beer for less than the maximum they were willing to pay for it. If they weren’t, by definition, they wouldn’t buy it.

All of this might sound a bit arcane, but it has real world implications and imposes economic costs. There are very few monopolies in fact. Even so, there is a large governmental apparatus tasked with finding them, breaking them up, or preventing them. They impose the cost of funding them. They also impose a cost in lost economic activity as businesses have to comply with these largely arbitrary rules.

John Phelan is an economist at Center of the American Experiment.