In the 1980s, Minnesota cut its top rate of income tax by 8 percentage points. What happened to income tax revenues?

Last week, I wrote about how, in Minnesota, higher income tax rates have not brought more revenue as a share of the state’s GDP. We can see this in more detail by examining a previous episode of tax cutting in Minnesota.

1984 to 1988

Department of Revenue data shows that between 1984 and 1988, Minnesota’s top rate of income tax was cut from 16% to 8%. The result, in nominal terms, was a rise in income tax revenues from $2.32 billion in 1984 to $2.62 billion in 1988. In real terms (2017 $), this translated into a slight fall from $5.44 billion to $5.41 billion. As a share of Minnesota’s GDP, income tax revenue fell from 3.2% in 1984 to 2.9% in 1988.

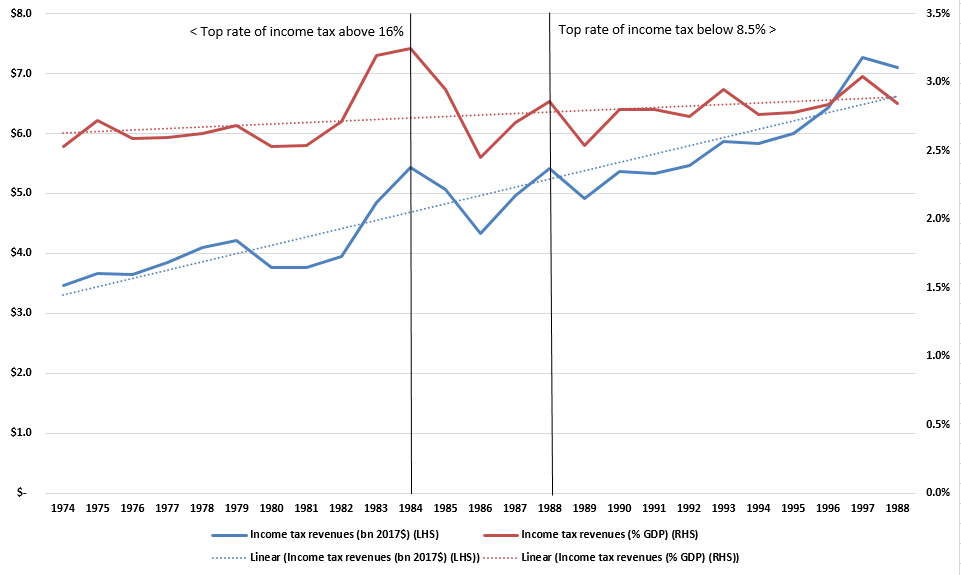

But 1984 was a bumper year for income tax collections. In 2017 dollars, revenues were higher that year than in any year since at least 1974. In only one other year prior 1992 were they as high. In fact, in 2017 dollars, income tax revenues in the ten years before 1984, when the top rate of income tax was 16% or above, averaged $3.9 billion. In the ten years after 1988, when the top rate of income tax was 8.5 at most%, they averaged $6.0 billion. Figure 1 illustrates this.

The same is true if we look at income tax revenues as a share of state GDP. In the ten years before 1984, when the top rate of income tax was 16% or above, Minnesota’s income tax revenues had averaged 2.7% of state GDP. In the ten years after 1988, when the top rate of income tax was 8.5% at most, Minnesota’s income tax revenues averaged 2.8% of state GDP. In other words, with a top income tax rate around eight percentage points lower in the period 1989 to 1998 than in the period 1974 to 1983, income tax revenues were higher as share of state GDP by one percentage point. Again, Figure 1 illustrates this.

Figure 1: Minnesota income tax revenues, 2017 $ and as a % of state GDP, 1974 to 1998

Source: Minnesota Department of Revenue

The lesson is that both of these measures of income tax revenues are, in fact, pretty independent of the top income tax rate. On this evidence, reducing tax rates will neither ‘starve the beast’, as some on the political right hope, nor lead us back to a Dickensian dark age, as some on the political left fear.

John Phelan is an economist at the Center of the American Experiment.