Higher tax rates doesn’t necessarily mean higher tax revenues

One of the great myths of public policy is that politicians can help themselves to more money simply by raising tax rates. As the evidence shows, it ain’t necessarily so.

We have written about this previously in the context of Minnesota’s fiscal history. Since 1974, top rates of state income tax have been as high as 17% and as low as 7.85%. Even so, over that time, state income tax revenues have been a very stable share of state GDP; the mean average is 2.8% of state GDP, the median is 2.7%. The same is true of revenue more broadly, both the mean average and the median of state tax revenues as a share of GDP come in at 6.6%.

This issue is taking on new importance at the national level. Freshman Rep. Alexandria Ocasio-Cortez (D–N.Y.) has floated the idea of increasing the top marginal income tax bracket to 70 percent to help pay for her “Green New Deal” programs. But this assumes that these higher tax rates will bring forth the necessary revenues and this is far from a given. As Nick Gillespie writes for Reason,

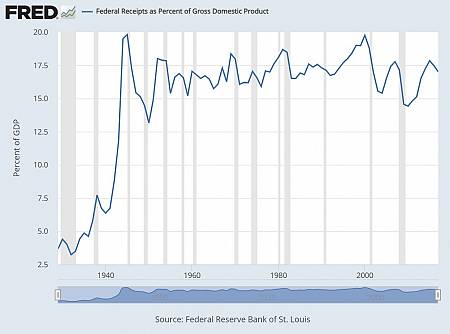

For any number of reasons, since the end of World War II, it has proven exceptionally difficult for the federal government to substantially increase overall revenues for any period of time. The entire country, it seems, has an aversion to paying more than about 18 percent of GDP in the form of total government revenues. Despite very different income tax brackets, corporate tax policy, you name it, it’s rare when the feds’ take tops 18 percent for very long (recall that both Al Gore and George W. Bush campaigned on tax cuts in 2000, after a series of big-revenue years for the federal government).*

Taxes are incentives. That is one reason why politicians levy them in the first place. When tax rates change so do people’s incentives. Their taxable behavior changes and so, in result, does the tax revenue received. Paying tax is, oddly, voluntary, to the extent that we can stop doing whatever it is that is being taxed.

If Rep. Ocasio-Cortez is serious about her “Green New Deal” she is going to have to get serious about funding it. She will have to take into account that fixed allowance from the American public of 18% of GDP and look for the fund there. This will mean cuts, heavy cuts, in other areas of federal spending. Until she can tell us what these might be, Rep. Ocasio-Cortez’s dreams will remain just that.

*Something similar is also the case in Britain.

John Phelan is an economist at the Center of the American Experiment.