Lower taxes, not tax credits, are good for state fiscal health

Back in August 2017, when Wisconsin was selected as the site of a major investment by Foxconn, I wrote a post titled ‘Subsidizing business is a bad idea whoever does it‘ criticizing the deal. I noted that

There is an extensive economics literature on why government subsidies to business are generally a bad idea. If an investment is a good idea, why isn’t someone doing it already? The notion that politicians make better investors than, well, professional investors, would seem optimistic.

While, as I wrote around the same time, Government letting companies and people keep more of their money is not a ‘handout’, a particular feature of the Foxconn deal was the use of ‘refundable’ tax credits. These enable a business to reduce its tax bill below zero and get a rebate – an actual handout – from taxpayers. This is corporate welfare, pure and simple. Government should not be ‘picking winners’ with taxpayers money. Not only is it morally suspect, it isn’t good from an economic standpoint.

A new paper from economists at North Carolina State University makes this point. The authors note that “Financial incentives are typically offered either as a tax credit, tax abatement, or grant.” They also point out that

Previous work on financial incentives has investigated the return on investment that incentives provided. Research has shown that while there may be some economic return, it is often less than what was expected or promised.

This paper looks specifically at the impacts of offering these incentives on state fiscal health. They find that ” financial incentives negatively impact the overall fiscal health of the states offering the incentives.”

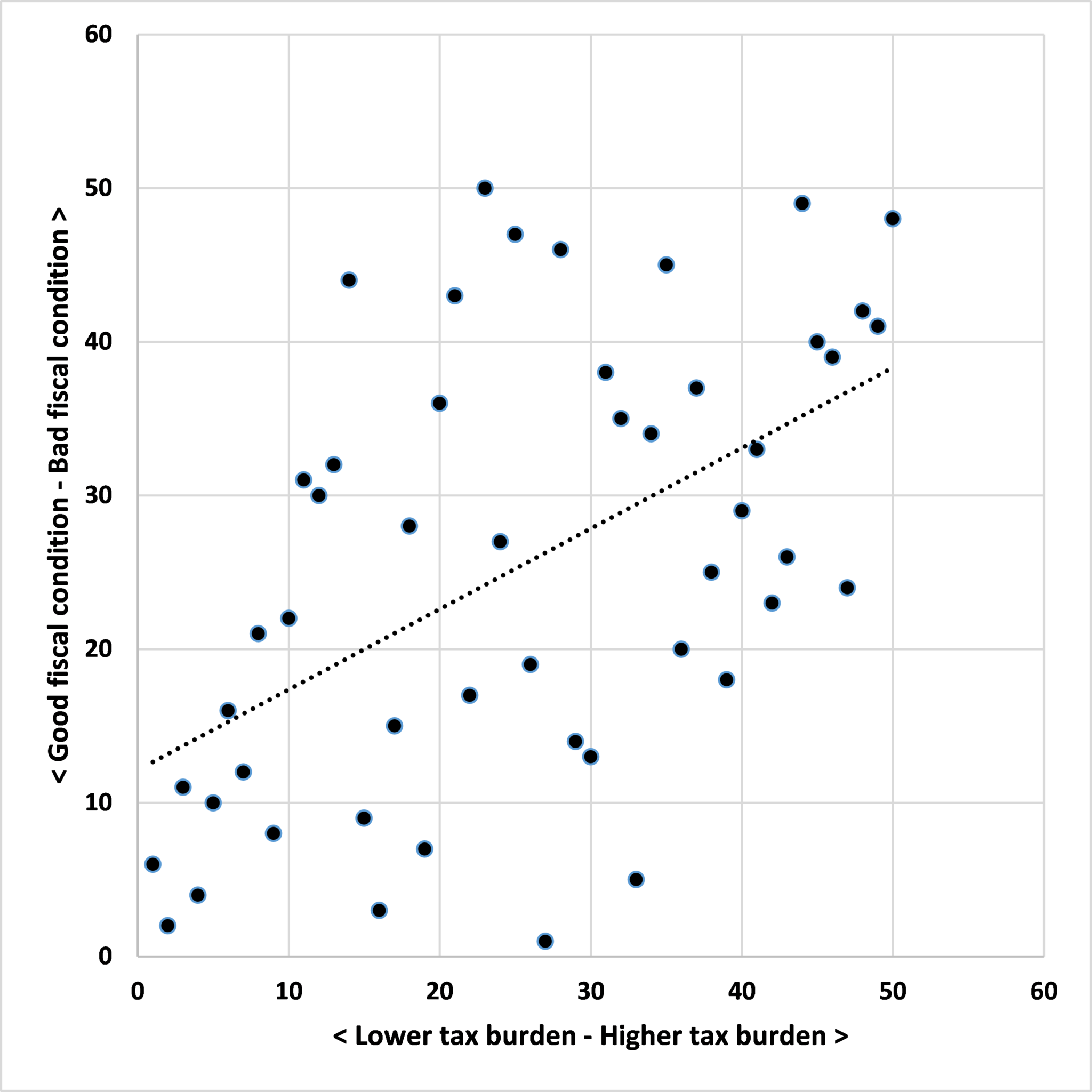

Rather than offering a rag bag of incentives, it seems that the best way to encourage a strong economy and healthy public finances is with simple taxes levied at a low rate on a broad base. Indeed, as data from the Mercatus Center at George Mason University on State Fiscal Rankings and from the Tax Foundation for overall ranking of state tax burdens shows, states with lower tax burdens tend to be in better fiscal health then those with higher tax burdens, as Figure 1 illustrates.

Figure 1: State tax burden and fiscal condition rankings, 2016

Source: and the Tax Foundation

John Phelan is an economist at the Center of the American Experiment.