House Democrats Propose Billions In Additional Subsidies for Wind, Solar, and Electric Cars

Advocates of wind and solar power often argue that wind and solar power are now the lowest cost sources of electricity on the market, making them more competitive than fossil fuels and nuclear power. If this is true, why do the wind and solar industries keep asking for more subsidies?

The answer, of course, is that wind and solar are entirely dependent upon the government subsidizing and mandating these products.

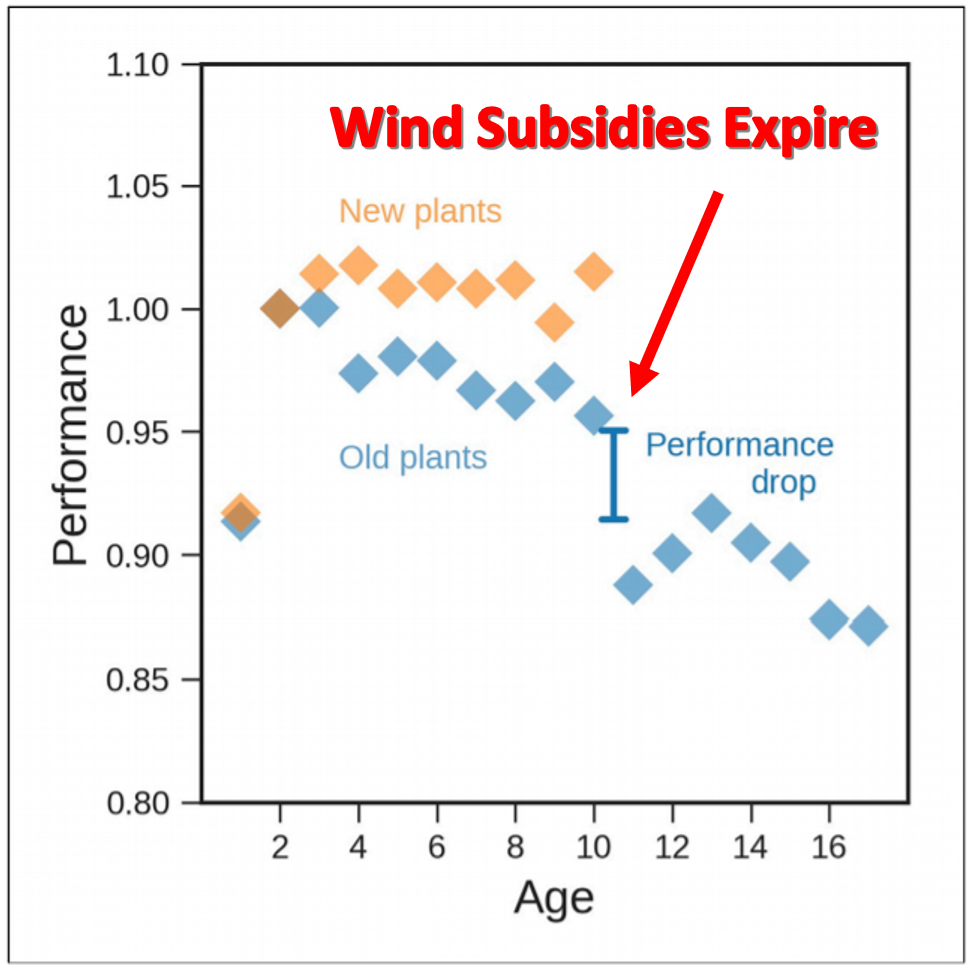

Subsidies are so important to the wind industry that many companies stop taking good care of their turbines once the facilities are no longer eligible for the subsidies, according to an analysis by the Lawrence Berkeley National Laboratory. As companies dial back their maintenance expenditures on their turbines, production drops by about 13 percent.

Given this reality, it is little surprise that Democrats in the U.S. House of Representatives have introduced the Growing Renewable Energy and Efficiency Now (GREEN) Act in an attempt to bail out wind, solar, and electric car companies with more of your money.

According to the Daily Energy Insider:

“This bill uses our tax code to expand the deployment of renewable energy by extending and expanding the federal tax incentives to promote clean energy technologies and supports widespread deployment of zero-emissions vehicles,” Thompson said…

“For solar, the bill would include direct pay while extending the solar Investment Tax Credit (ITC) through 2025, at 30 percent. A two-year step-down period would follow, beginning in 2026 at 26 percent, then to 22 percent in 2027, and down to 10 percent in 2028 for commercial and utility-scale solar projects and 0 percent for residential solar. It also creates a new investment tax credit for energy storage with an additive measure that would increase the value of the ITC by 10 percent, supposing companies meet certain labor requirements.”

“The bill does not neglect wind power, either. The American Wind Energy Association (AWEA) has likewise backed the measure for its efforts to extend the expiring Renewable Energy Production Tax Credit and ITC for five years for both onshore and offshore wind energy. Other energy sources have permanent tax credits. The measure would also allow direct payment worth 85 percent of the credit values to help companies use the credits.”

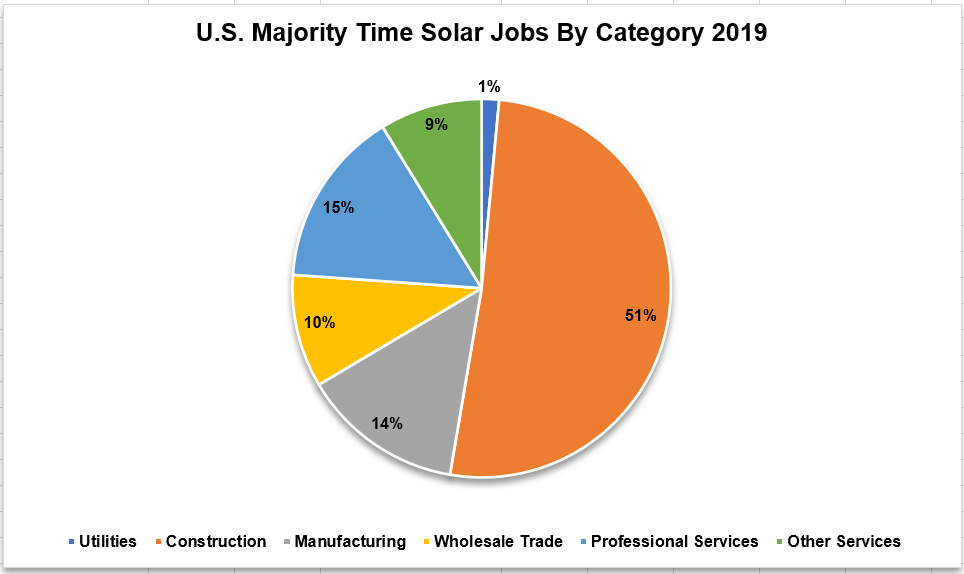

Supporters of wind and solar claim these technologies are important job creators, but they seldom admit that many of the jobs in these industries are temporary construction jobs. Construction jobs are good jobs, but it is important for the general public to understand that wind and solar are not a mechanism for creating long-term employment.

Wind and solar also destroy other jobs by increasing the cost of electricity, which is a double whammy to businesses. Not only do businesses have higher overhead costs, which means they’ll have to raise their prices, but their customers will also have less money to purchase goods and services.

One of the biggest problems with government favoritism in the energy space is that it prevents losers from losing. I firmly believe that someday we will look back at this period of time and wonder why we thought using wind and solar would be a good idea. Unfortunately, this realization will likely come too late, and we will be left with electricity prices that are much higher than they are today.

Minnesota needs meaningful electricity reform that allows all consumers to shop around for their electricity provider. Only then will the bad incentives utility companies like Xcel have to build wasteful projects be curbed.