High interest on credit cards? Blame strict regulations for that

Unsecured debt like credit cards is generally associated with a high-risk premium. This manifests through high-interest rates in the case of credit cards. However, starting in 2010 this risk climbed up dramatically. This despite the fact that the market was recovering from the recession, and the risk of having uncollected debt (Charge off) was falling. According to new research, this trend can be explained by new regulations that followed the banking crisis.

The 2008 financial crisis

What caused the financial crisis of 2008 is probably up to debate for some people. However, the aftermath shows what policymakers concluded was the cause of the crisis; lack of regulation in the financial sector. Therefore to prevent another crisis from happening, legislators tightened regulation governing banking institutions. Whether they intended it or now, this has brought serious implications on people. And one of them is raising the cost of obtaining credit.

According to a new study by Matthias Fleckenstein and Francis A. Longstaff, new regulations imposed after the crisis raised balanced sheet costs for institutions issuing credit and debt. These institutions potentially reacted by passing on those costs to consumers. As explained by the authors,

The results suggest that much of this increase may be due to the additional balance-sheet costs and capital constraints that intermediaries now face in the post-financial-crisis period. In particular, recent capital regulation may have added hundreds of basis points to the overall cost of obtaining unsecured consumer credit in the credit card market. Finally, these results can provide useful historical perspective about the pricing of unsecured household credit risk.

Other effects of post-recession banking regulation

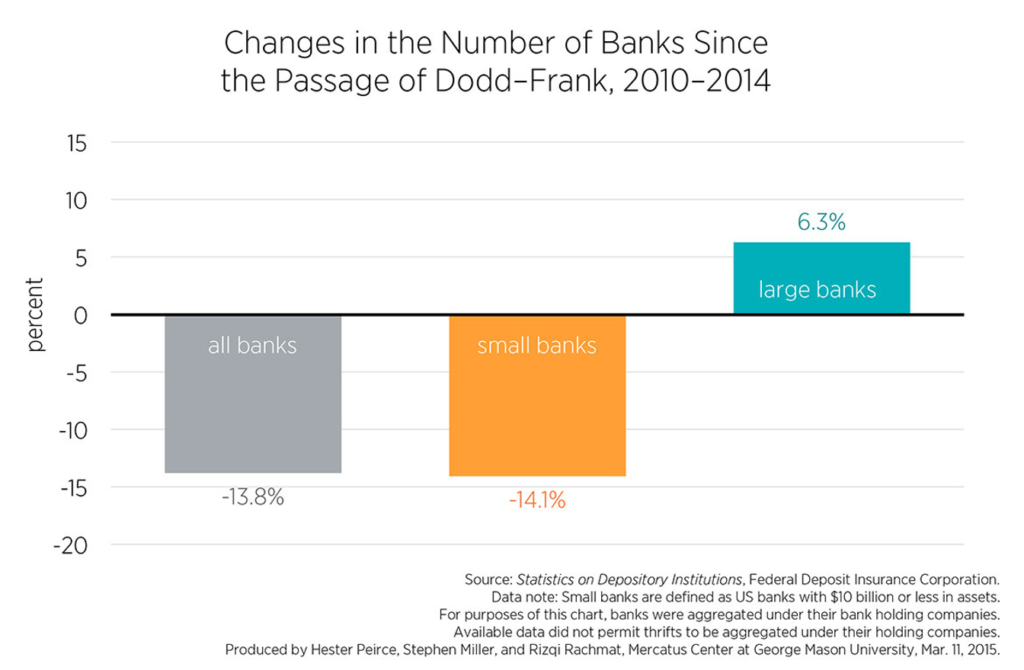

High interest on credit cards has not been the only result of the regulation that followed the financial crisis. In fact, high compliance costs that were imposed hurt small banks. And unfortunately, small banks are the backbone of small businesses. So, this one act that was meant to put banks in place ended up hurting small businesses and all the other establishments that rely on small banks.

Big banks, however, since they are more established, survived. And additionally, smaller banks consolidated. All of this however is harmful to small communities and small businesses. Small banks are more friendly to small businesses. Bank consolidation hurts them and hurts the economy in turn.

There are so many examples that we can point to where regulation intended to protect consumers has ended up hurting them. And if anything, this should be a big sign of just how harmful excessive government oversight is to the economy, at every turn.