Minnesota’s policymakers need to be aware of Iowa’s tax reforms

On Friday, I wrapped up my short tour of Minnesota’s borders where I’ve been presenting the findings of our new report, Minnesota’s Border Battles: How state policy affects economies at the margin, which looks at how state’s economic policies impact their economic outcomes by focusing on those border areas.

After our event in Albert Lea, I received an email from an attendee which read, in part:

You are spot on that border counties have less policy space, and I can tell you firsthand that the work we do in neighboring Austin when it comes to trying to address economic development, stimulate housing, and attract and retain residents is directly impacted by Iowa policies. It seems like state policy considerations all too often stop at the edge of the Twin Cities.

Sadly for my correspondent, this situation is about to get worse. For my presentations in Stillwater and Duluth last week, I was joined by our friends from the Badger Institute and Katherine Loughead, a Senior Policy Analyst with the Tax Foundation. Her presentation is shown below:

[embeddoc url=”https://files.americanexperiment.org/wp-content/uploads/2020/11/TF-Presentation-10.29.20-10.30.20-WI-and-MN-2021-Index-Rankings-For-the-Badger-Institute.pptx” viewer=”microsoft”]

The following slide, in particular, made me think of my correspondent from Albert Lea:

As our friends at the Tax Education Foundation of Iowa – who joined us for the Albert Lea event – wrote recently:

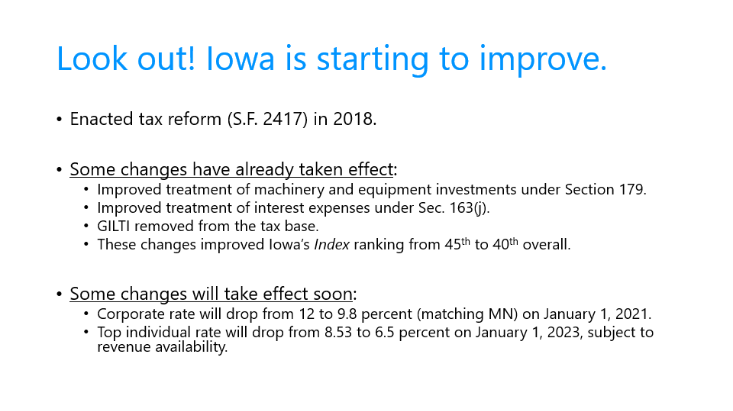

In 2018, the legislature passed a tax reform law that lowered both individual and corporate income tax rates and broadened the sales tax base. The 2018 tax reform law took a phased-in approach and it will take several years to fully implement.

At 12 percent Iowa has the highest top corporate tax rate. In 2021, Iowa’s corporate tax rate is scheduled to fall from 12 percent to 9.8 percent. In 2023, if revenue triggers are met, Iowa’s top income tax rate is scheduled to fall from 8.53 percent to 6.5 percent. The Tax Foundation credits recent tax reforms by the legislature which helped improve Iowa’s ranking.

Indeed, from 2020 to 2021, Iowa saw its State Business Tax Climate Index ranking rise from 45th to 40th. Policymakers in Saint Paul should take note.

John Phelan is an economist at the Center of the American Experiment.