To climb tax rankings, Minnesota can reform its corporate tax base

Recently, I wrote about how Minnesota had slipped a place, to 46th, on the Tax Foundation’s 2021 State Business Tax Climate Index. This was largely driven by our state’s high corporate tax rates – where we rank 6th highest in the United States – and our individual taxes, where we rank 5th highest in the United States. To make serious progress up these rankings, we need to see these rates come down.

But there are other things dragging Minnesota down on these rankings which would help us climb them if remedied. They are not huge changes such as cutting our corporate and income tax rates would be, but every little helps, as they say.

Conform to the federal depletion schedule

One of these measures would be to reform Minnesota’s corporate tax base. For example, our state is one of thirteen that doesn’t fully conform to the federal system for the deduction for depletion. This works like depreciation, but applies to natural resources. By imposing its own schedule, Minnesota makes it’s tax system is more complex than it need be. Conforming to the federal schedule would help this.

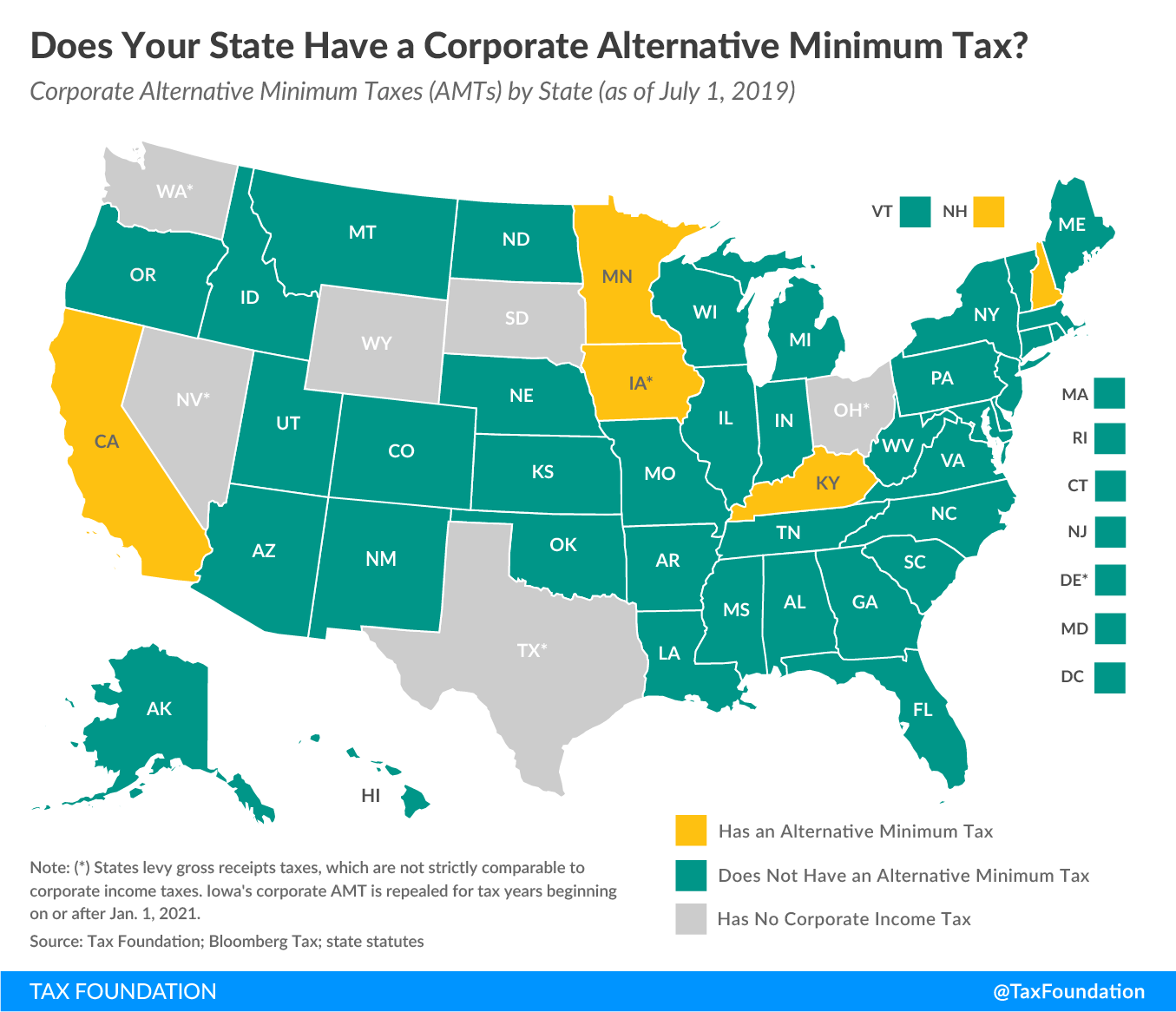

Abolish Minnesota’s Alternative Minimum Tax for corporations

Another would be to ditch its alternative minimum tax (AMT) for corporations, something we at the Center have long argued for. These corporate AMTs exist to prevent corporations from reducing their corporate income tax liability beyond a certain level, and Minnesota is one of only five states – down from eight as recently as 2017 – which imposes one. According to the Tax Foundation:

The corporate AMT is an inefficient means of ensuring taxpayers pay a minimum level of taxes each year, a factor which contributed to its repeal in several states and on the federal level. By requiring taxpayers to calculate their tax liability under two different systems, the federal AMT imposed steep compliance costs on businesses, which in some cases proved larger than collections. States that have not yet repealed their AMTs ought to consider whether the relatively small amount of additional revenue they gain from corporate AMTs is worth the added complexity of maintaining two parallel tax systems, and whether one streamlined corporate tax code with fewer deductions is a more efficient means of meeting annual revenue targets.

As the Minnesota Center for Fiscal Excellence puts it:

With the federal repeal of the AMT and various modifications throughout the Internal Revenue Code, the Minnesota AMT would be even more complicated and burdensome and certainly no picnic for the Department to audit. While waiting on the Department’s revenue estimate for the cost of this proposal, it’s worth noting the last time they published a corporate income tax bulletin (about a decade ago) the corporate AMT constituted about 1% of state corporate income tax collections. Given the current circumstances, that’s not worth retaining.

A bill to repeal Minnesota’s corporate AMT was proposed by Ann Rest (DFL) and passed in 2018, but was a casualty of one of then Governor Mark Dayton’s tantrums, when he vetoed the tax bill.

These two measures – conforming to the federal schedule for depletion and abolishing the corporate AMT – wouldn’t send Minnesota rocketing up the rankings. But they would be baby steps in the right direction.

John Phelan is an economist at the Center of the American Experiment.